Sales Tax Formula Excel 2007

In this example the formula in F7 is saying IFE7 Yes then calculate the Total Amount in F5 825 otherwise no Sales Tax is due so return 0 Note. The sales tax in a Purchase order i want it to be like that if it has the word included chosen from a drop down menu then the sales tax cell shall be 0.

How To Calculate Sales Tax In Excel

Ad Present Your Data In Compelling Ways With Microsoft Excel - See Plans Pricing.

Sales tax formula excel 2007. Tax Rates In Excel Easy Excel Tutorial. In this video I will show you how to calculate sales Tax in Microsoft Excel Do Subscribe to My Channel for MoreSubscribe for More httpbitly2PLMnH. IF oknTaxable_1oknLineTotal_1oknTax1RateIF oknLineTotal_10- This formula means that if the Taxable checkbox is checked on the first line of the invoice body identified by the oknTaxable_1 cell value it calculates tax amount.

Calculate tier 2 tax by subtracting the limit from the amount and multiplying the result by the tier 2 tax rate 10. In the condition you can figure out the sales tax as follows. In this condition you can apply the Vlookup function to calculate the income tax for a certain income in Excel.

If the sales tax rate is 725 divide the sales. Im creating a spreadsheet in Microsoft Excel. I need to be able to have the sheet calculate sales tax for orders but only if the customer is from NY state.

Add up all the sales taxes. Select the cell you will place the sales tax at enter the formula. Advanced Excel 2007 TABLE OF CONTENTS.

The Excel formula of the tax amount cells are like the following. Hey guys I need a formula for the following issue. Excel 2007 Excel 2003.

Otherwise if included is not chosen then sales tax. Take the total price and divide it by one plus the tax rate. Excel Formula Tax Rate Calculation With Fixed Base Exceljet.

In order to calculate sales tax with Excel type in the amount of a purchase and multiply it by the states sales tax which has to be converted into decimal. In some regions the tax is included in the price. Formula To Calculate Sales Tax From Total Sales Jan 4 2005.

To use this formula you first need to add up all applicable sales taxes. Ad Present Your Data In Compelling Ways With Microsoft Excel - See Plans Pricing. Create A Simple Sales Tax Calculator Spreadsheetconverter.

We have been figuring the sales tax ourselves and filling in the chart on excel but I would like to create a formula. Named ranges can make formulas easier to write and read. Multiply the result from step one by the tax rate to get the dollars of tax.

Calculate sales tax if you get tax-inclusive price. If you are going to use text in formulas you need to. Then look to see if your county or city applies any additional sales taxes.

Ad Enhance Your Excel Skills With Expert-Led Online Video Tutorials - Start Today. Subtract the dollars of tax from step 2 from the total price. Select the cell you will place the calculated result enter the formula.

Add tier 1 tax to tier 2 tax and return a final result. The Excel sales tax decalculator works by using a formula that takes the following steps. Download the Free Sales Tax Decalculator Template.

Sales Tax Invoice Format In Excel. I have created a chart on excel for us to track daily sales but also to figure sales tax so we know what to send the IRS each month. In other words if the sales tax rate is 6 divide the sales taxable receipts by 106.

How to calculate sales tax in Excel. In the condition you can figure out the sales tax as follows. Multiply by the sale price.

Tips Tricks. Add the sales tax to the sale price. Start by determining what the sales tax rate is in your state.

In this condition you can easily calculate the sales tax by multiplying the price and tax rate. Select the cell you will place the calculated result at enter the formula. Otherwise I need the tax.

As a sales tax rate. Select the cell you will place the sales tax at enter the formula E4-E4 1E2 E4 is the tax-inclusive price and E2 is the tax rate into it and press the. Sales Tax Total 2 3 Printer 345 185 C3-D3 E3C7 E3F3 4 Computer 985 265 5 Monitor 395 98 6 7 Sales Tax 06 8 9 Average Cost AVGG3G5 10 Grand Total SUMG3G5 Exercise 2.

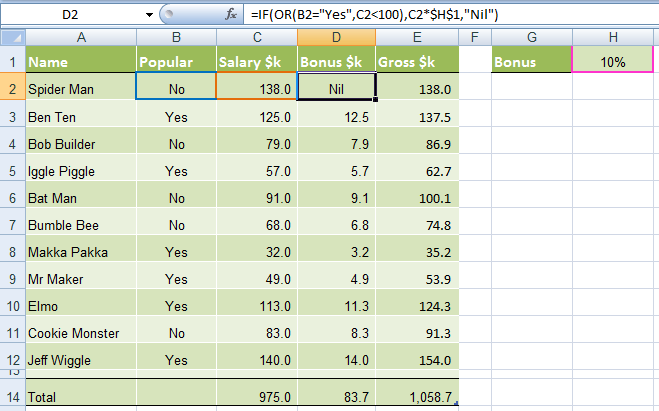

Using the PMT Function. Ad Enhance Your Excel Skills With Expert-Led Online Video Tutorials - Start Today. Using the IF function to calculate sales tax.

To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1 the sales tax rate. A Smarter Way To Calculate Grand Totals In Excel Intheblack. Sometimes you may get the price exclusive of tax.

How To Calculate Sales Tax In Excel

Formulas To Include Or Exclude Tax Excel Exercise

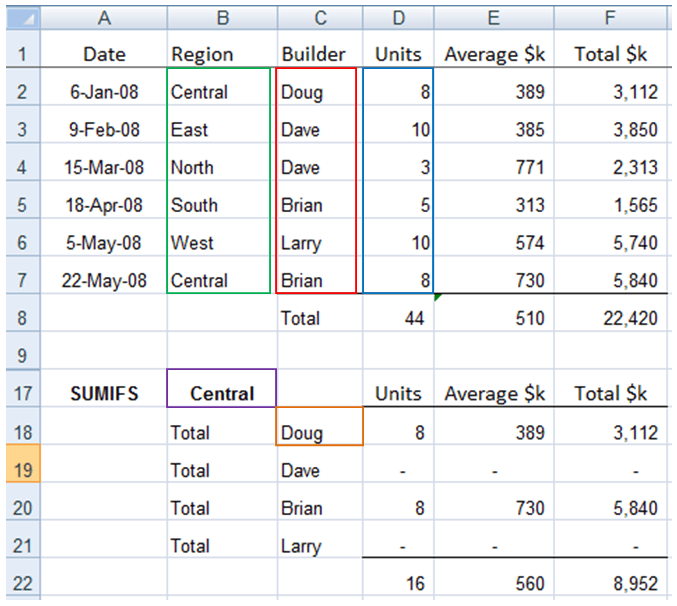

Excel Sumif And Sumifs Formulas Explained My Online Training Hub

How To Calculate Income Tax In Excel

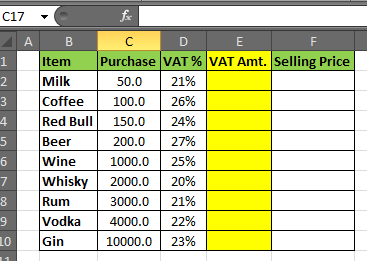

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

How To Calculate Income Tax In Excel

Formulas To Include Or Exclude Tax Excel Exercise

Excel If And Or Functions Explained My Online Training Hub

Excel Tutorial Formulas For Calculating Gst At 15 Youtube

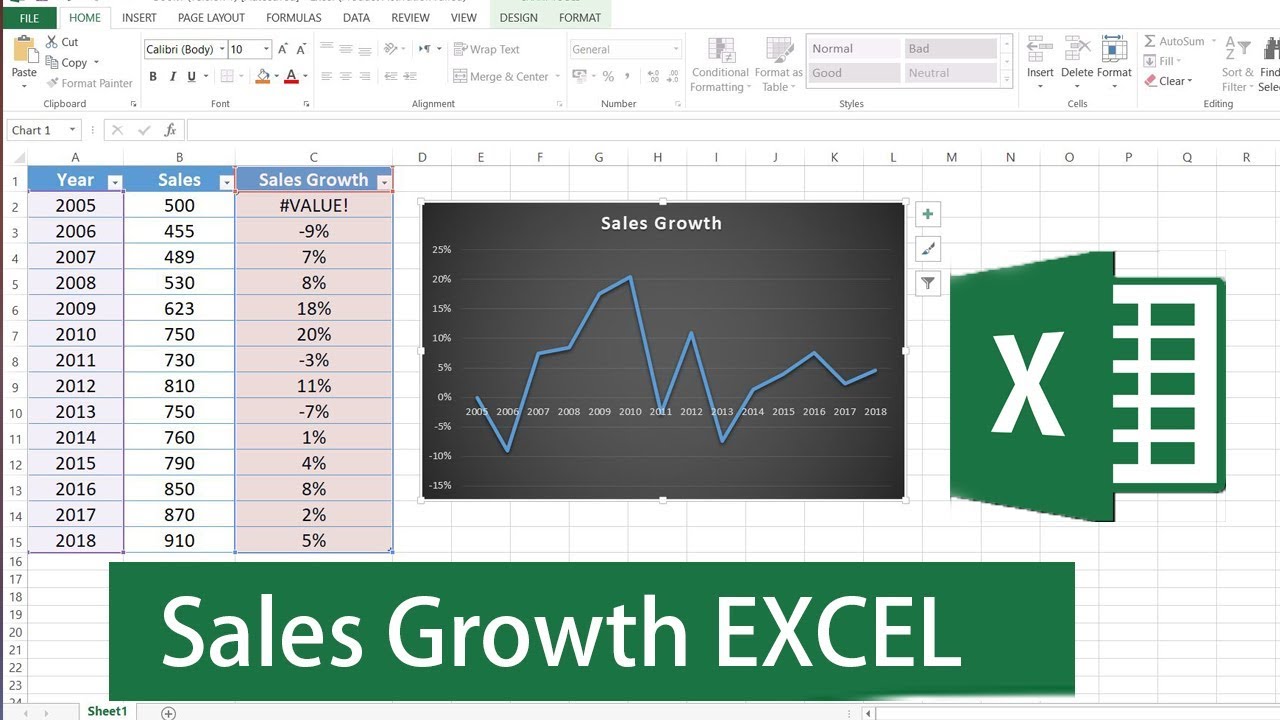

Trapping Errors Within Excel Formulas Accountingweb

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel Tutorial Youtube

Formulas To Include Or Exclude Tax Excel Exercise

Formulas To Include Or Exclude Tax Excel Exercise

Formulas To Include Or Exclude Tax Excel Exercise

How To Calculate Sales Tax In Excel Tutorial Youtube

How To Calculate Income Tax In Excel

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

How To Calculate Income Tax In Excel

Posting Komentar untuk "Sales Tax Formula Excel 2007"