Good Capital Investment Opportunities Are Most Likely To Exist When

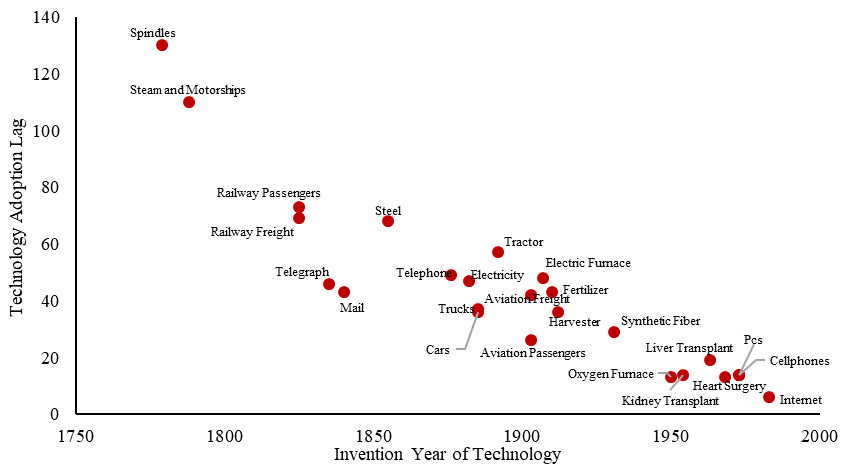

Most companies make long-term investments that require a large amount of capital Capital Capital is anything that increases ones ability to generate value. The international capital markets allow individuals companies and governments to access more opportunities in different countries to borrow or invest which in turn reduces risk.

Toward A Robust Competition Policy Center For American Progress

For example investments in your knowledge might be considered human capital but this isnt viewed as a capital investment.

/Convexity22-0370dbde8e1c4a958bff8b670bf8bf5c.png)

Good capital investment opportunities are most likely to exist when. True Real options are options to buy real assets like stocks rather than interest-bearing assets like bonds. Investments in health care and education and sociopolitical and economic stability. This is a common criticism of current accounting.

Answer 4 questions to get started. Cumulated investments over time give rise to capital opening the path to improvements in production conditions. Energy needs are likely to remain unmet for hundreds of millions of house-.

What is a Capital Investment Model. Capital letters combined with figures. Likewise structural capital social capital and innovation capital can be impossible to capitalize.

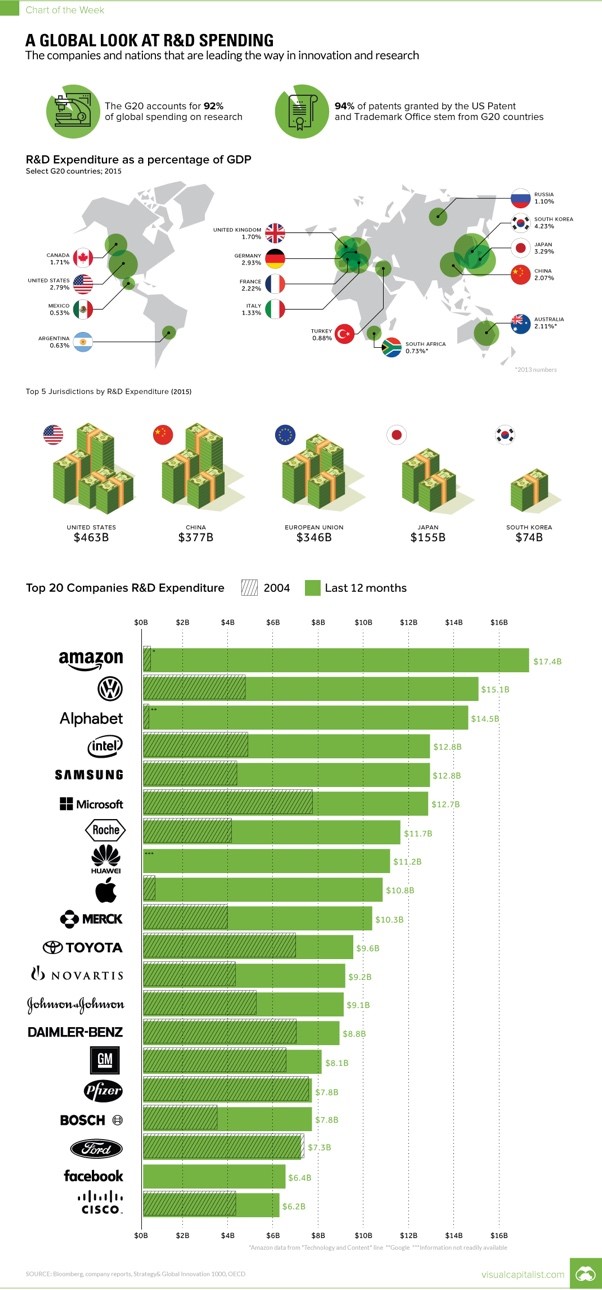

A number of additional factors weigh into venture capital decisions including the team the proof of concept the size of the market and the terms of the investment. The theory is that not all markets will experience contractions at the same time. Production capacity potential productivity cost effectiveness production and process quality will be all increased by properly-oriented investment.

Answer 4 questions to get started. D If the yield curve is inverted short term bonds have lower yields than long term bonds. According to Dr.

Ajay Tyagis 2017 book Capital Investment and Financing for Beginners Forbes has reported that bank lenders are often looking for at least three years of financial data. This investment will cost the firm 100000 today and the firms cost of capital is 10. Most would say that a business consistently netting 10M per year is a good business but that fact alone leaves an.

1 STESA344 ISBN 978-92-1-109167-0. OurCrowd has VC opportunities from all sectors. C The most likely explanation for an inverted yield curve is that investors expect inflation to decrease.

E Inverted yield curves can exist for Treasury bonds but because of default premiums the corporate yield curve can never be inverted. Assume cash flows occur evenly during the year. What these investment flows reflect then is a consistent pattern of capital allocation into industries where most companies are likely to look good in the near term.

Settings foreign investments that introduce goods and services that are new to the domestic economy be they for the export or domestic market are more likely to have favourable effects on capital formation than foreign investments in areas where there already exist domestic producers. So what do venture capitalists look for in a business. 2 Many types of intangible capital are not considered a capital investment according to current accounting practices.

Where are the Opportunities for Investment in Healthcare. What Investors Look for in an Investment Opportunity. While essential a good idea is not enough.

Ad OurCrowd has investment opportunities from all sectors. It can be used to increase value across a wide range of categories such as financial social physical intellectual etc. Real options exist when managers have the opportunity after a project has been implemented to make operating changes in response to changed conditions that modify the projects cash flows.

The downside to an asset-heavy business is re-investment requirements. Climate change biggest investment opportunity since the internet An estimated 41 trillion is required to decarbonise the planet giving investors the chance to. 28 The Seattle Corporation has been presented with an investment opportunity which will yield cash flows of 30000 per year in Years 1 through 4 35000 per year in Years 5 through 9 and 40000 in Year 10.

The structure of the capital markets falls into two componentsprimary and secondary. Stephen Knight 90 president and managing partner of the healthcare-focused venture capital firm F-Prime Capital Partners talks to Yale Insights about how the company evaluates startupsand why launching a company yourself is sometimes the most profitable route.

Startup Fundraising Is The Most Tangible Gender Gap How Can We Overcome It Techcrunch

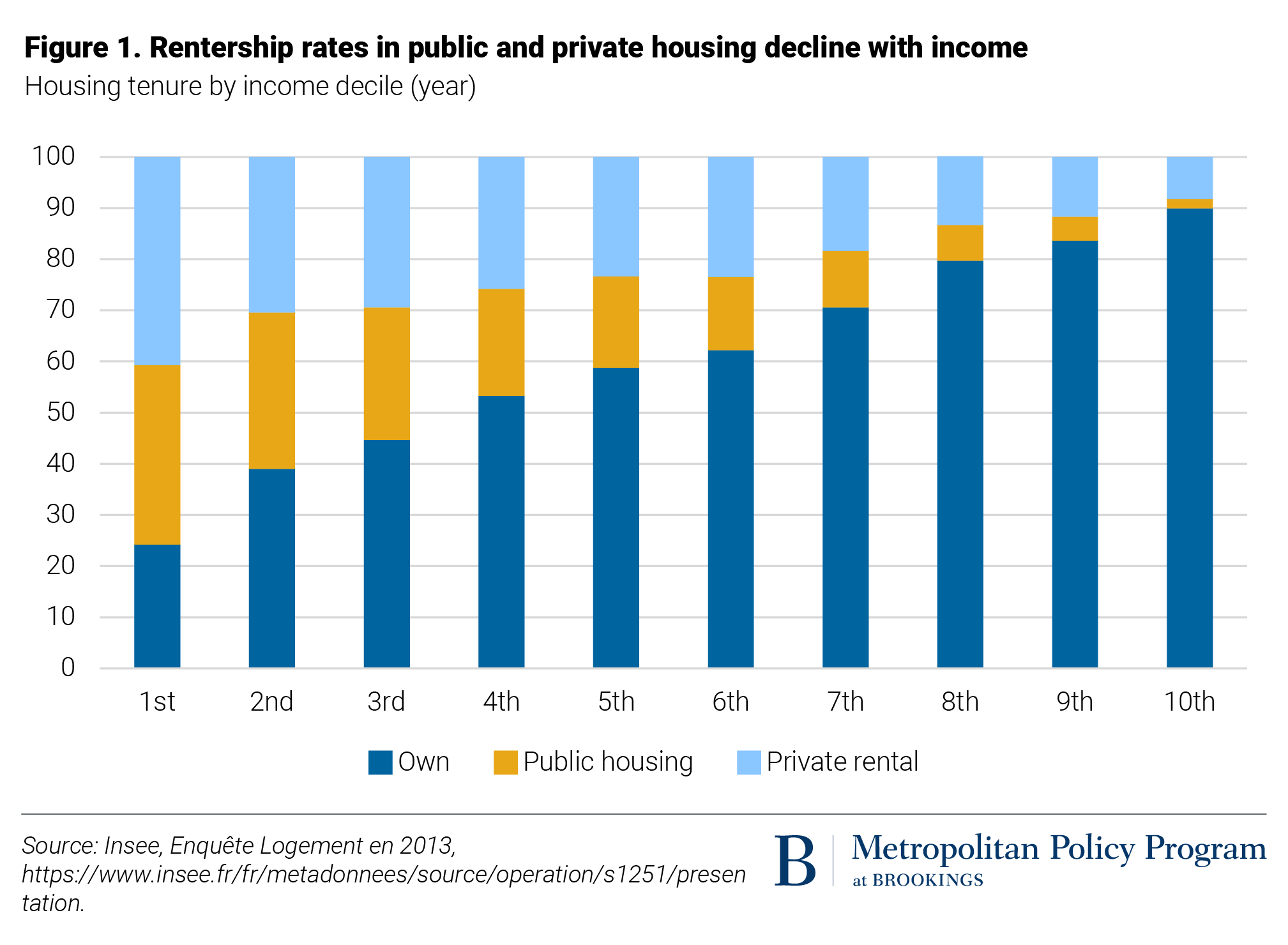

The Public Sector Plays An Important Role In Supporting French Renters

The Abcs Of The Post Covid Economic Recovery

Businesses Owned By Women And Minorities Have Grown Will Covid 19 Undo That

:max_bytes(150000):strip_icc()/SyntheticPut2-2067bf135ad24dfbbbca207754a84218.png)

Understanding Synthetic Options

Why Are North And South India So Different On Gender

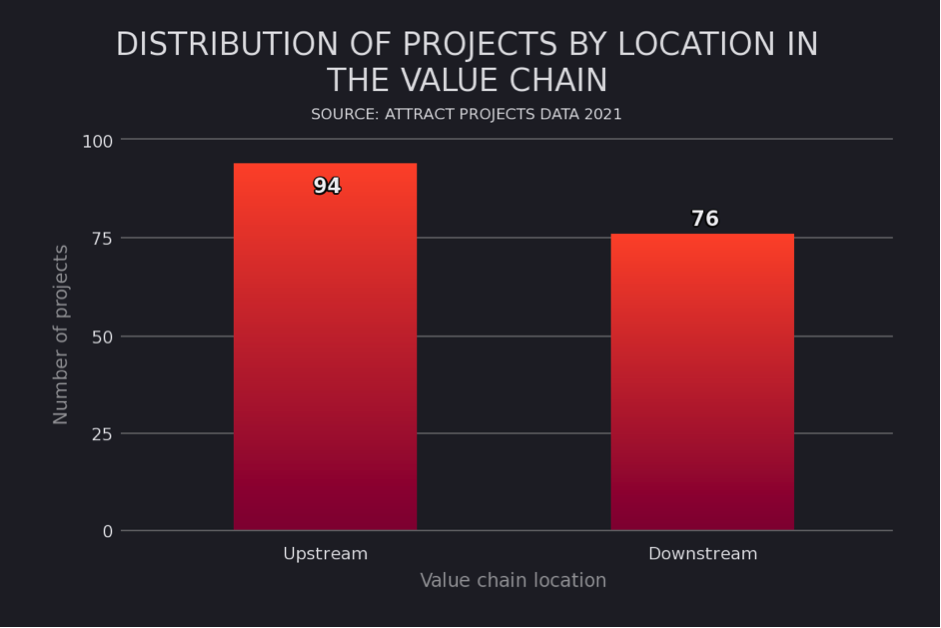

Making A Success Of Deep Tech What The Data Tells Us The Lisbon Council

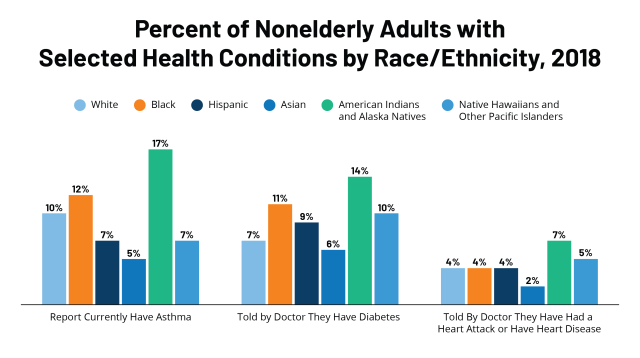

Communities Of Color At Higher Risk For Health And Economic Challenges Due To Covid 19 Kff

How Banks Can Succeed With Cryptocurrency Bcg

Esg Environmental Social And Governance Overview And Framework

Whoever Leads In Artificial Intelligence In 2030 Will Rule The World Until 2100

Businesses Owned By Women And Minorities Have Grown Will Covid 19 Undo That

Whoever Leads In Artificial Intelligence In 2030 Will Rule The World Until 2100

:max_bytes(150000):strip_icc()/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

Posting Komentar untuk "Good Capital Investment Opportunities Are Most Likely To Exist When"