Derivatives Presentation In Financial Statements

Us Financial statement presentation guide 1953 ASC 815-10-50-1Ad requires disclosure about the volume of derivative activity. NOTE 7 Derivative Instruments Sample Illustrative may not tie to exhibits.

Ifrs 9 Derivatives And Embedded Derivatives Financial Instrument Economic Environment Financial Asset

26 Notes The notes are part of the financial statements and complement the balance sheet the off-balance-sheet the income statement the cash flow statement and the statement of changes in equity.

Derivatives presentation in financial statements. It is settled at some future date. A derivative is a financial instrument whose value depends on or derives from. Hillary Clintons 1979 Investment in Cattle Futures.

However an entity may use other titles eg balance sheet instead of statement of financial position for the statements identified in IAS 1 IAS 110. Reporting Requirements for Annual Financial Reports of State Agencies and Universities Notes Samples. The Example Financial Statements use the terminology in IAS 1 Presentation of Financial Statements.

The information contained in these illustrative financial statements is of a general nature relating only to private investment companies only and is not intended to address the circumstances of any particular entity. This table titled The Effect of Fair Value and Cash Flow Hedge Accounting on the Statement of Financial Performance will capture the impact of both effective. Derivative instruments are classified within Level Two and Level Three of the valuation hierarchy.

The form and content of financial statements are. PRESENTATION 7 Only those interests in controlled entities joint ventures and associates that are measured in an entitys separate financial statements using cost or the equity method are excluded from the scope of IPSAS 28. Best efforts commitments fix the forward sales price that will be realized upon the sale of mortgage loans into the.

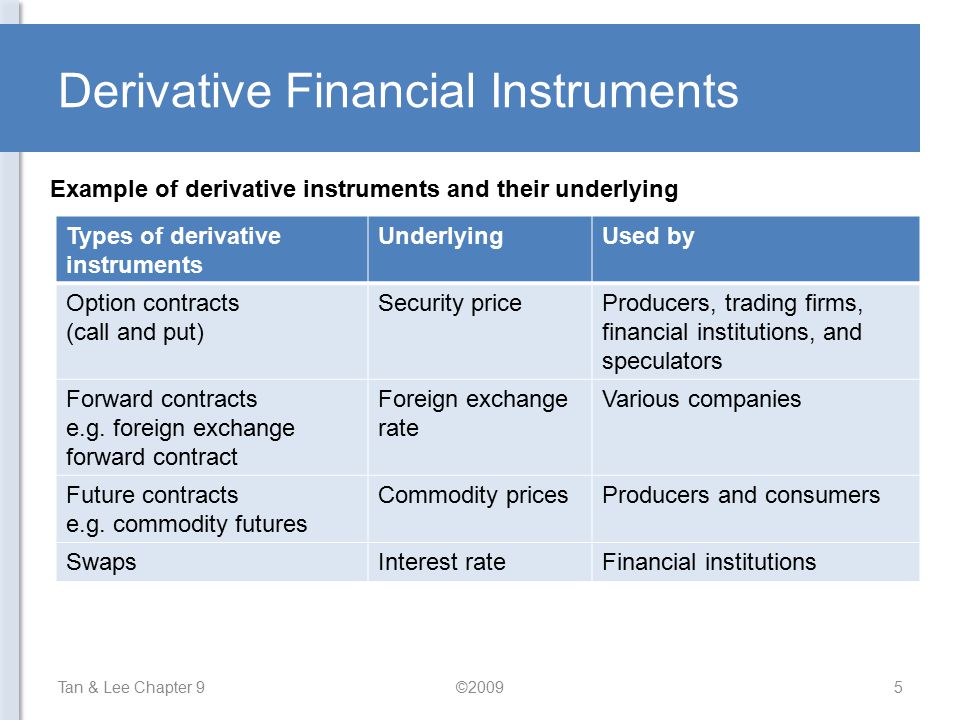

The types of derivatives used by the Group are set out below. The format and specifics of these disclosures should be what is most relevant and practicable for the reporting entitys individual facts and circumstances. The IFRIC was asked to provide guidance on whether derivatives that are classified as held for trading in accordance with IAS 39 Financial Instruments.

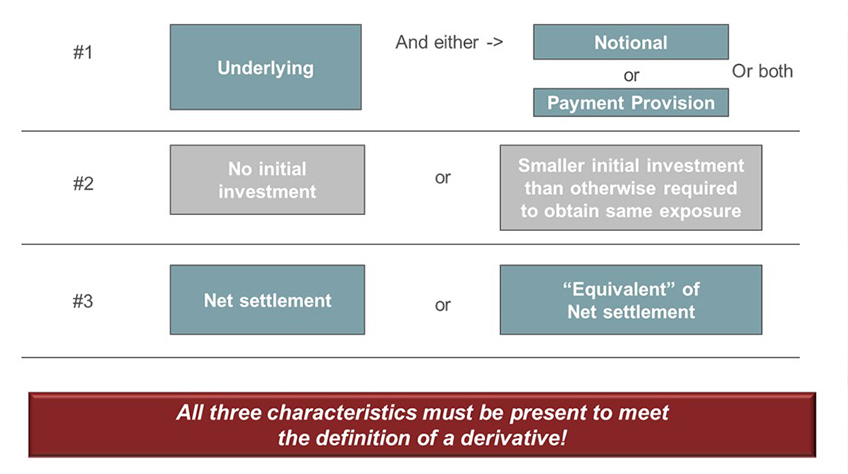

A Derivative is a financial instrument or other contract carrying all of the following three characteristics-Its value changes in response to the change in the underlying asset. Recognition and Measurement should be presented as current or non-current in the balance sheet. A derivative security is a financial instrument whose value depends on the value of another asset.

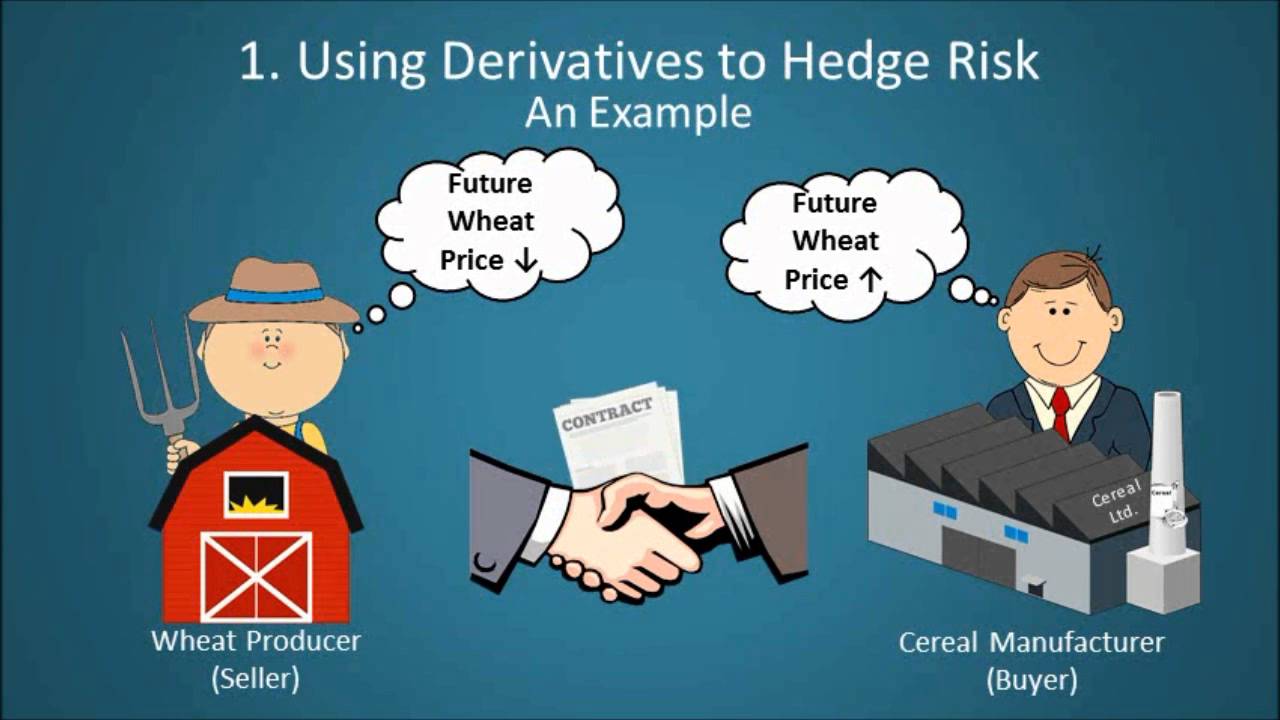

Derivatives linked to interests in. IAS 138A requires an entity to present at a minimum. By using derivatives companies and individuals can transfer for a price any desired risk to other parties who either have risks that offset or want to assume that risk.

To mitigate the income statement volatility of recording a swaps change in fair value Topic 815 permits an entity to. Best efforts commitments are classified within Level Two of the valuation hierarchy. IAS 1 Presentation of Financial Statements sets out the overall requirements for financial statements including how they should be structured the minimum requirements for their content and overriding concepts such as going concern the accrual basis of accounting and the currentnon-current distinction.

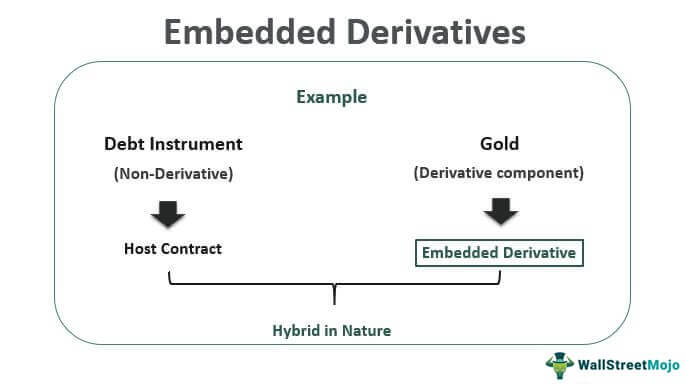

The hedging instrument in the same income statement line item in which the earnings effect of the hedged item is reported. However the Company did not properly account for certain embedded derivatives. Appropriate financial statement presentation and disclosure is key to achieving the objectives of financial reporting including providing decision-useful information to investors lenders creditors and other stakeholders.

Derivatives are financial instruments that derive their value in response to changes in interest rates financial instrument prices commodity prices foreign exchange rates credit risk and indices. What is a Derivative. All derivatives are classified as trading and recognised and subsequently measured at fair value with all revaluation.

The standard requires a complete set of financial statements to comprise a. However errors in the statement of cash flows continue to be causes of restatements and registrants continue to receive comments from the SEC staff on cash flow presentation matters. An example is a call option on a stock which gives the holder the right to buy a share of the stock for a given price say 10.

Derivative instruments are financial instruments whose values are derived in whole or in part from the value of any one or more underlying assets or index of asset values. IFRS 9 contains presentation guidance. The new disclosure table requires an all-encompassing impact-to-earnings table which will include the derivative-related amounts reported in earnings by income statement line by hedge designation type and also by asset class being hedged.

This presentation enables users of financial statements to better understand the results and costs of an entitys hedging program. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. Derivatives are financial instruments whose returns are derived from those of other financial instruments.

This guide has been prepared to support practitioners in the preparation of their financial statements. Presentation requirements are outlined in Annex 4 of the Circular. Presentation in Financial Statements 8.

If the price of the stock is 15 per share then the exercise. The statement of cash flows primarily that in ASC 2301 The accounting principles related to the statement of cash flows have been in place for many years. Now constitutes an integral component of the financial statements.

Such derivatives may be settled more than one year after the balance sheet date. Topic 815 Derivatives and Hedging requires that an entity recognize all interest rate swaps on its balance sheet as either assets or liabilities and measure them at fair value. It requires no initial net investment or a small initial investment.

Based on our analysis we have concluded that the Preferred Stock was properly accounted for as Mezzanine Equity consistent with the SECs Accounting Series Release No 268 Presentation in Financial Statements of Redeemable Preferred Stocks ASR 268 and Emerging Issues Task Force Issue D-98 Classification and Measurement of Redeemable Securities EITF D-98.

Advanced Financial Accounting Chapter 9 Ppt Download

Financial Derivatives Explained Youtube Financial Derivative Explained

What Is Underlying Asset Accounting Principles Budgeting Budgeting Money

Financial Analyst Resume Sample Good Objective For Resume Sample Resume Templates Business Analyst Resume

Advanced Financial Accounting Chapter 9 Ppt Download

Derivatives And Hedge Accounting An Overview Of Asc 815 Gaap Dynamics

2012 The Dangers Of Financial Derivatives

Derivatives Market Types Features Participants And More In 2021 Derivatives Market Learn Accounting Investors Business Daily

Advance Course For Financial Advisory Learn How To Accurately Interpret Financial Statements Using The Stock Market Courses Stock Market Portfolio Management

Financial Statement Templates 13 Free Word Excel Pdf Statement Template Financial Statement Financial Position

Identifying And Accounting For Embedded Derivatives Under Asc 815 Gaap Dynamics

Ifrs 9 Impairment Financial Instrument Time Value Of Money Financial Asset

Ifrs 16 Leases Accounting Principles Finance Lease Lease

Ias 38 Intangible Assets Intangible Asset Asset Financial Asset

Ias 27 Separate Financial Statements Financial Statement Financial Financial Instrument

Financial Market With Bond And Derivatives Market Presentation Graphics Presentation Powerpoint Example Slide Templates

Embedded Derivatives Examples Accounting Ifrs

Derivatives And Hedging Accounting Vs Taxation

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Derivative_Aug_2020-01-8b165b177a3a4a06951b2c33dede9f8a.jpg)

Posting Komentar untuk "Derivatives Presentation In Financial Statements"