Merger Of Equals Structure

Seller merges into Buyer with Buyer as surviving corporation Note. John Knight 112818.

They have debated the pros and cons of MOEs such as the financial attributes and the.

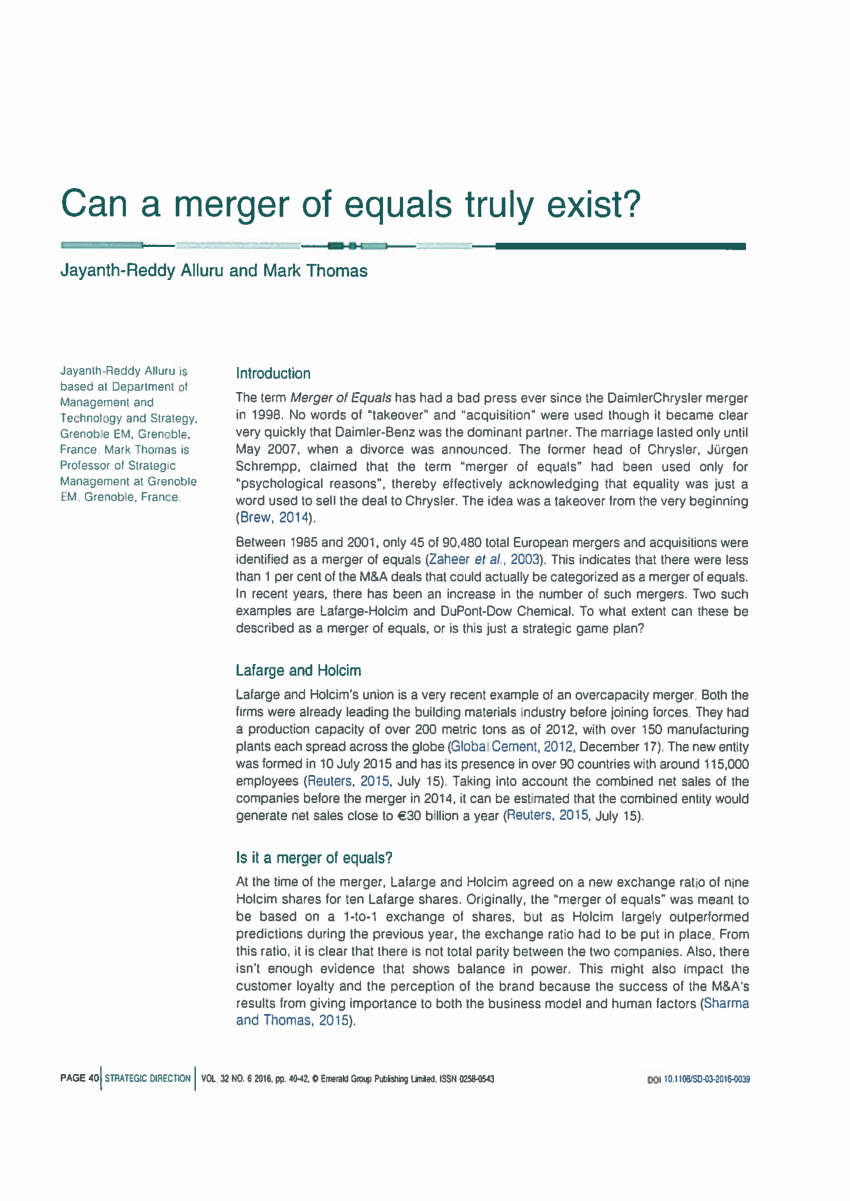

Merger of equals structure. When addressing corporate governance aspects of mergers cross-border activities are of special interest. Corporate marriages often go wrong but mergers of equalsin which two firms of roughly similar size combine with neither a buyer nor a target and typically no cash changing handsaccount for. January 15th 2020.

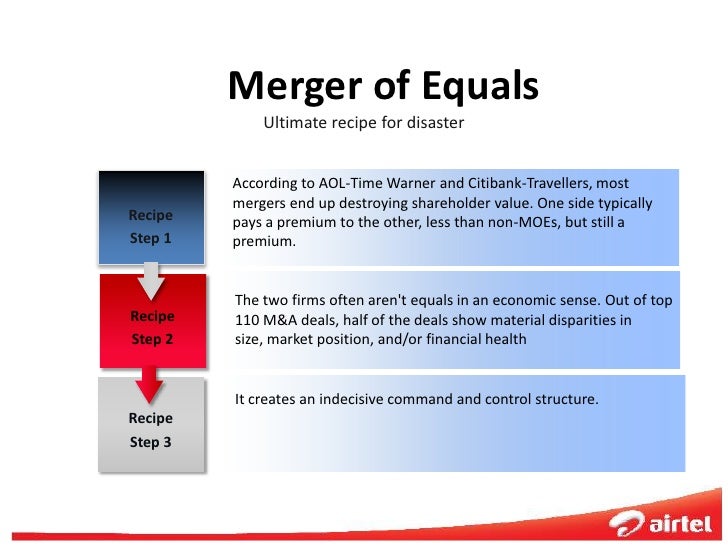

The media has been ablaze recently with the dramatic news about the termination of the 35 billion merger of equals between global advertising media and communications leaders Publicis Groupe SA and Omnicom Group Inc. Industry insiders have discussed the pending rise of low-premium merger-of-equals transactions over the last several years including whether they will become more common. However where one party is the purchaser a merger may be the preferred choice.

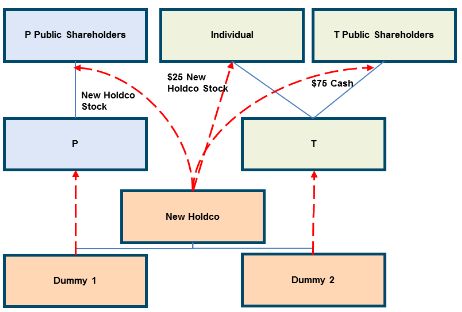

A New Structure for Merger of Equals or Other Large Stock-for-Stock Public Mergers merger can be substantially decreased as well as provide the merger parties with additional benefits. Saracen will also pay a special fully franked dividend of A38 per Saracen. United Technologies and Raytheon Complete Merger of Equals Transaction.

Requires approval of Buyers stockholders as. This article provides detailed step-by-step guidance on completing a double dummy dual exchange. Even though the term may not hold specific legal meaning or.

Collecting data at both 3 and 4 years after the In short a merger of equals cultivates expectations of wide business synergies as well as fairness mutual trust in each others intentions and deeds and the presentation of a united front. The objective to create a merger of equals has led to new and interesting properties of. The merger of equals structure allows shareholders of both Bonanza Creek and Extraction to benefit from the cost synergies and significant upside potential of the combined company.

In glaring front page and above-the-fold headlines The Wall Street Journal proclaimed on April 26 Clashes Over Power Threaten 35 Billion Ad Agency Merger and finally on May 9 Merger of Ad. Creates the worlds most advanced aerospace and defense systems provider. The two executives who co-led the Value Creation Integration Office VCIO Rory Read chief integration officer for Dell and chief operating.

Mergers of equals has more of everything In contrast to smaller fintech buys MOEs typically have more of everything. A merger of equals is a situation in which two firms of roughly the same size choose to combine into a single business entity. A merger of equals occurs when two firms choose to combine into a single entity.

Commercially and optically companies might proceed by way of an amalgamation if structuring the business combination as a merger among equals given that neither company is deemed to be the survivor. More deposits branches customers lines of business LOBs employees systems regulatory exposure and risk. Merger Three basic structures all of which involve statutory mergers in which Sellers outstanding stock is converted into the right to receive stock of Buyer cash or other consideration.

It is increasingly possible that the banking industry could see an increase in merger-of-equals transactions. Speakers on the subject sometimes state that a true merger of equals MOE does not exist in banking because there is always a buyer and a seller. Expects to introduce breakthrough technologies at an accelerated pace across high-value areas of commercial.

Serves customers worldwide through a platform-agnostic diversified portfolio of industry-leading businesses. Merger of equals is a phrase that is thrown around in deal negotiations and disclosures often without a full appreciation of its meaning or lack thereof as was laid bare in the acrimonious litigation over the DaimlerChrysler combination. No deal is easy to execute but a merger of equals serves as a true testament of two.

Management declared was a merger of equals. The merger of Dell and EMC in September 2016 to form Dell Technologies not only resulted in a company with 74 billion in annual revenue and 140000 employees worldwide but also a case study on how to meld two global high-tech organizations into a single entity. Agreed to a merger-of-equals via a Saracen Scheme of Arrangement under which Northern Star will acquire 100 of the shares in Saracen Saracen shareholders to receive 03763 Northern Star shares for each Saracen share held at the Scheme record date.

In my view while that statement may generally be true it is not always true and MOEs do exist in banking and they can be a helpful bank merger structure under the right circumstances. This is different from mergers in which one company is identified as the acquiring entity and the other as the acquired business operation.

Achieving Tax Free Rollover Treatment For Certain Shareholders In Acquisition Of Publicly Traded Target Company Tax United States

Tender Offer Vs Merger One Two Step Mergers Wall Street Prep

Mergers Acquisitions M A Types Examples Process In 1 Guide

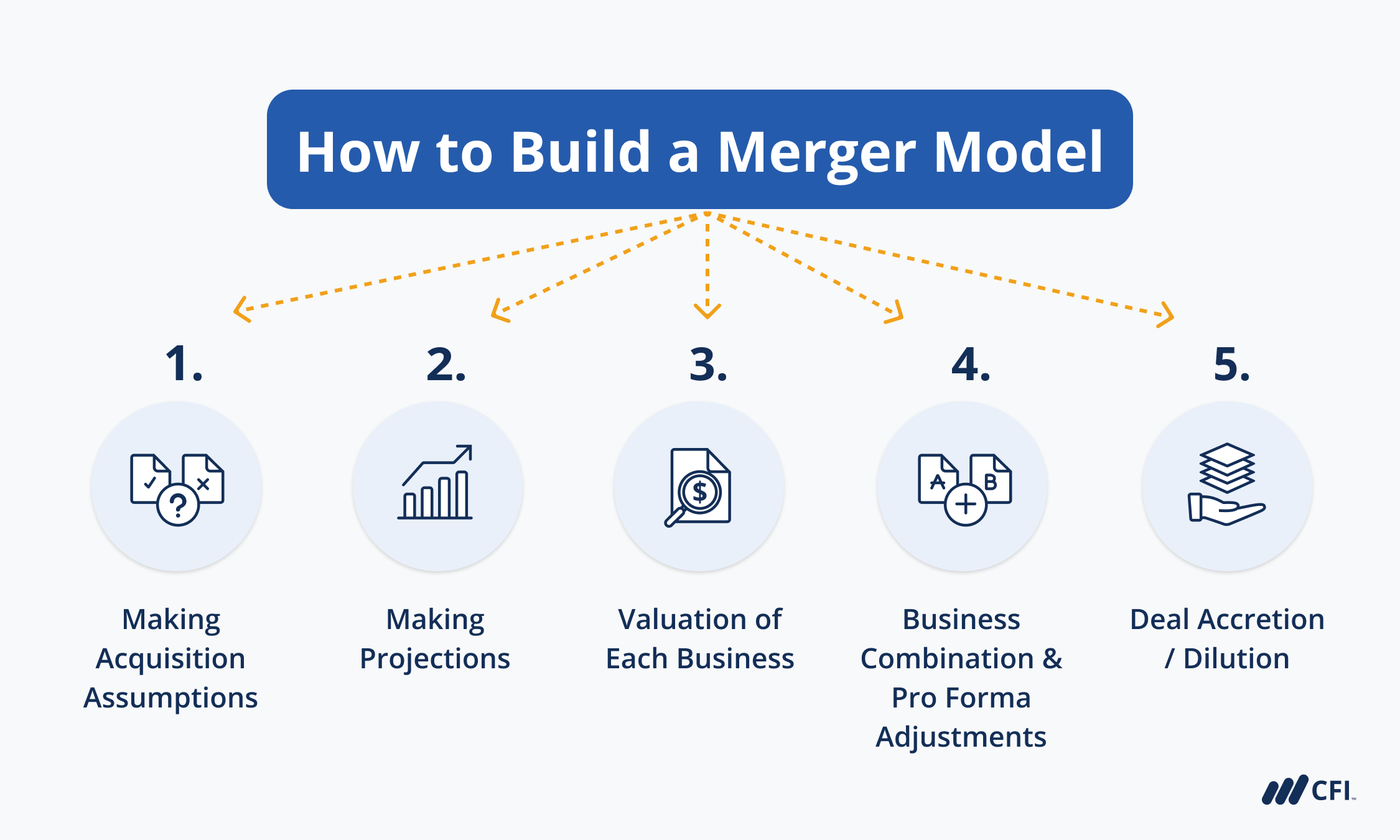

Merger Model Step By Step Walkthrough Video Tutorial

India Tender Offers 2017 The Year That Was Conventus Law

How To Build A Merger Model A Basic Overview Of The Key Steps

Pdf Can A Merger Of Equals Truly Exist

Integrating It Systems After A Merger Powerpoint Presentation Slides Integrating It Systems After A Merger Ppt Integrating It Systems After A Mergerintegrating It Systems After A Merger Presentation

United Technologies Aerospace Businesses And Raytheon Rtn To Combine In Merger Of Equals Slideshow Nyse Rtx Seeking Alpha

Mergers Acquisitions M A Types Examples Process In 1 Guide

Structuring The Deal Tax And Accounting Considerations Ppt Download

A Merger Of Equals Structure Highlights

Merger Of Equals Avant Advisory Group

Post Merger Integration Integrating It Powerpoint Presentation Slides Ppt Images Gallery Powerpoint Slide Show Powerpoint Presentation Templates

Posting Komentar untuk "Merger Of Equals Structure"