Cost Of Preferred Stock Formula

Interpretation of Preferred Dividend Formula. The cost of preferred stock formula.

Cost Of Preferred Stock Equity Financing In Startups Plan Projections

Rp D dividend P0 price For example.

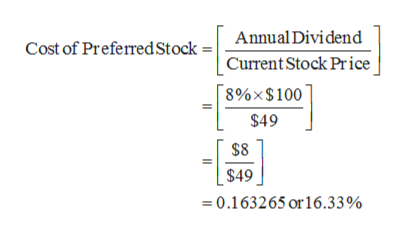

Cost of preferred stock formula. The formula is as follows. Calculate the cost of preferred stock. Where CPS is the cost of preferred stock DPS is the dividends per share.

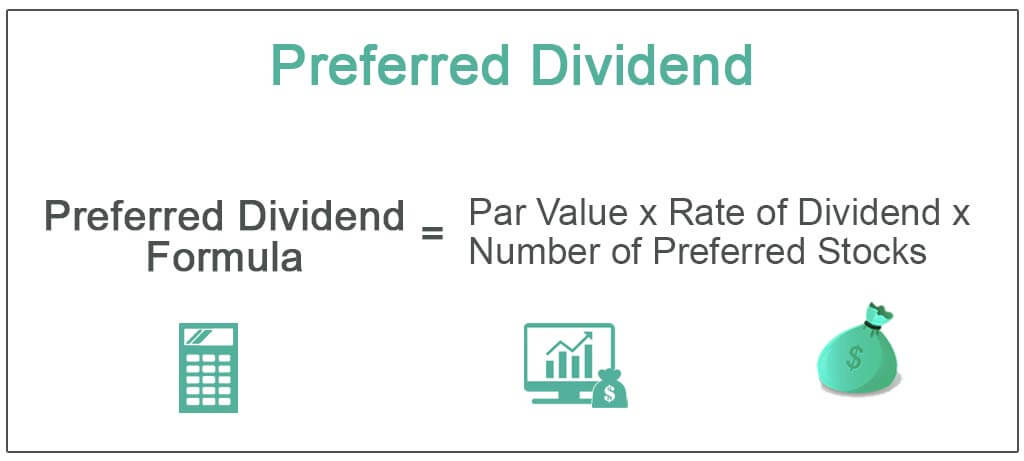

It has been determined that based on risk the discount rate would be 5. Preferred stock prices yields tend to change depending on the prevailing interest rates. R p cost of preferred stock.

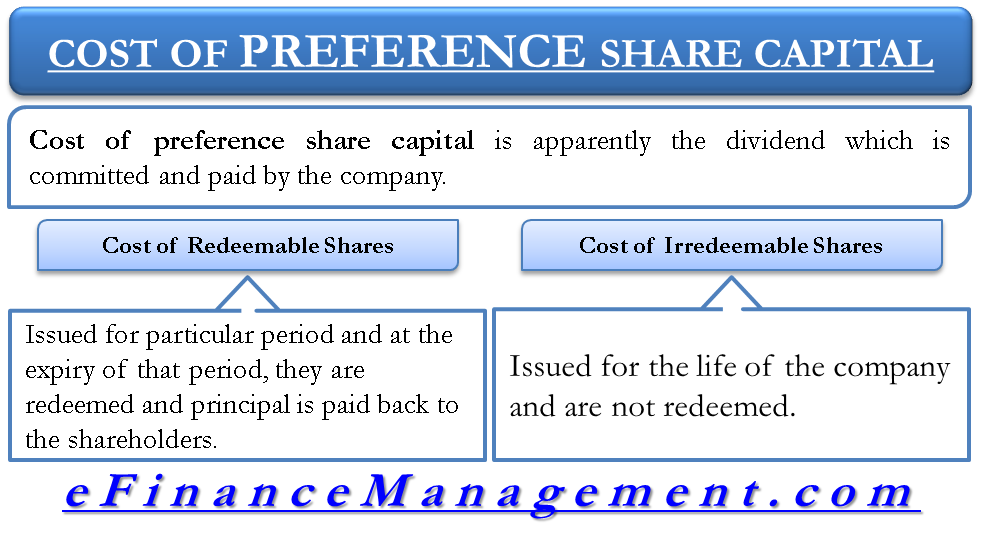

Although companies regularly finance themselves andor projects through common stock and bonds this is not always the case for preferred stock. Cost of preferred stock is the rate of return required by holders of a companys preferred stock. As the preferred stocks are currently outstanding thus we can calculate the cost of preferred stock by using the below formula.

CPS DPS PPS 100. P p current price of each preferred share. R p D p P p.

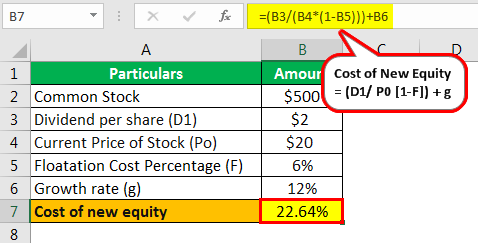

Rp 3 25 12. Stock dfrac 40 10 400 PreferredStock 1040. In this video we are going to learn what is cost of preferred stock.

The following equation is used to calculate the cost of preferred stock. Use our below online cost of preferred stock calculator by inserting the appropriate values on the input boxes and they clicking calculate button for. An individual is considering investing in straight preferred stock that pays 20 per year in dividends.

If no prefeered stock put any number except 0 here. K p DP. 4 200 1 - 008 22 Importance of determining preferred stock cost.

In most cases the cash flows stream of a preferred stock is a perpetuity because it has unlimited life and it pays a fixed amount of dividend each period. If no prefeered stock put 0 here. If the cost to issue new shares is 8 then the companys cost of preferred stock is.

Flotation percentage Flotation percentage flotation fee stock price. Compute the preferred stock value of person A. The following formula can be used to calculate the cost of preferred stock.

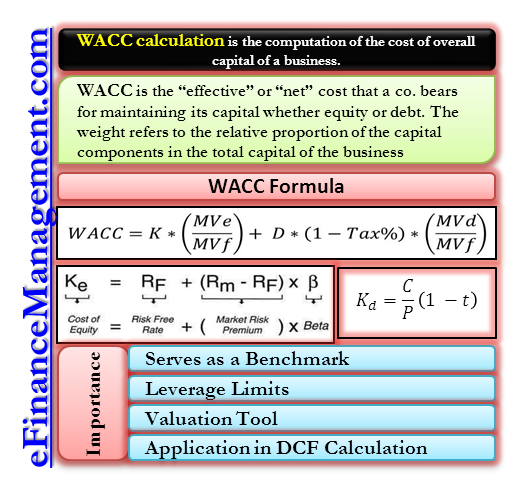

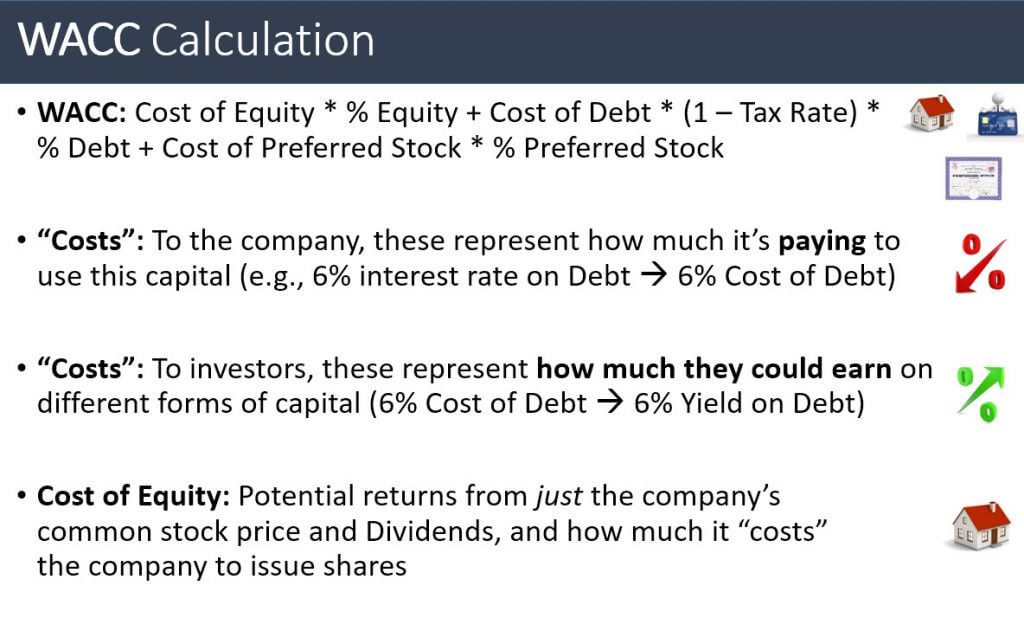

WACC E V R e D V R d 1 T c where. If the current share price is 25 what is the cost of preferred stock. The price the individual would want to pay for this security would be 20 divided by 05 5 which is calculated to be 400.

Along with its formula and types of preferred stock𝐖𝐡𝐚𝐭 𝐢𝐬 𝐂𝐨𝐬𝐭 𝐨𝐟 𝐏𝐫𝐞. If no prefeered stock put 0 or any other number here. Cost of Preferred Stock Example.

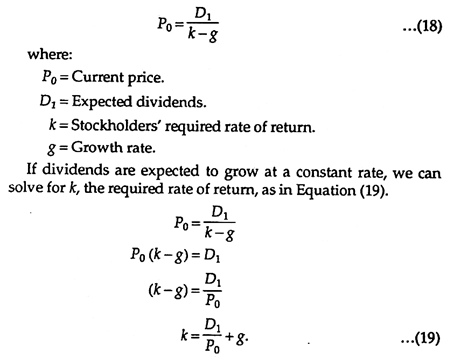

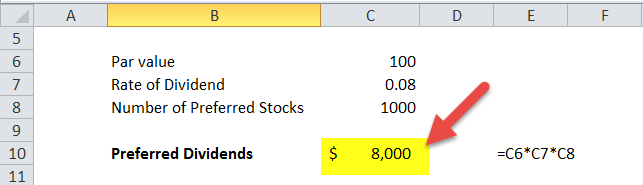

Cost of preferred share 801500 53. Interest Expense Amount of Preferred Stock. Annual preferred share dividend 1000 8 80.

Company A has 100000 outstanding shares of 1000 preferred stock which has a market price of 1500 each. Hence k p 215 133. E Market value of the firms equity D Market value of the firms debt V E D R e Cost of equity R d Cost of debt T c.

The formula to calculate cost of preferred stock is given by. Thus the cost of existing preferred stock is 133. If interest rates increase preferred stock prices can fall which will increase the dividend yields.

Currently the market value is at 15. Cost of preferred stock Dividend rate x Par value Share price. Cost of equity --cost of preferred stock.

P r e f e r r e d S t o c k 4 0 1 0 4 0 0. The annual fixed dividend is 8 per year. For this reason the cost of preferred stock formula mimics the perpetuity formula closely.

The formula for the cost of preferred stock is below. The cost of preferred stock is a simpler calculation since interest payments made on this form of funding are not tax-deductible. A company has preferred stock that has an annual dividend of 3.

Since the business receives the investment share price at issue in return for the dividends it has to pay the cost of preferred stock to the business is the same as the rate of return to an investor who buys the new issue. Cost of Preferred Stock. Person A will pay a price of 400 as the preferred stock value for the security.

D 20 10 2 annual fixed dividend P 0 15. The calculation of the cost of common stock requires a different type of calculation. In fact many companies do not issue preferred stock.

Rp D P0. Preferred stock is a type of stocks sold by the company where the stock holder owns part of the company and receives a fixed dividend and this cost rate of return is known as cost of preferred stock. D p preferred stock dividend per share.

It is calculated by dividing the annual preferred dividend payment by the preferred stocks current market price. Investors usually purchase preferred stock as a source of regular income in form of dividends.

Cost Of Preferred Stock With Flotation Costs Calculator Stocks Walls

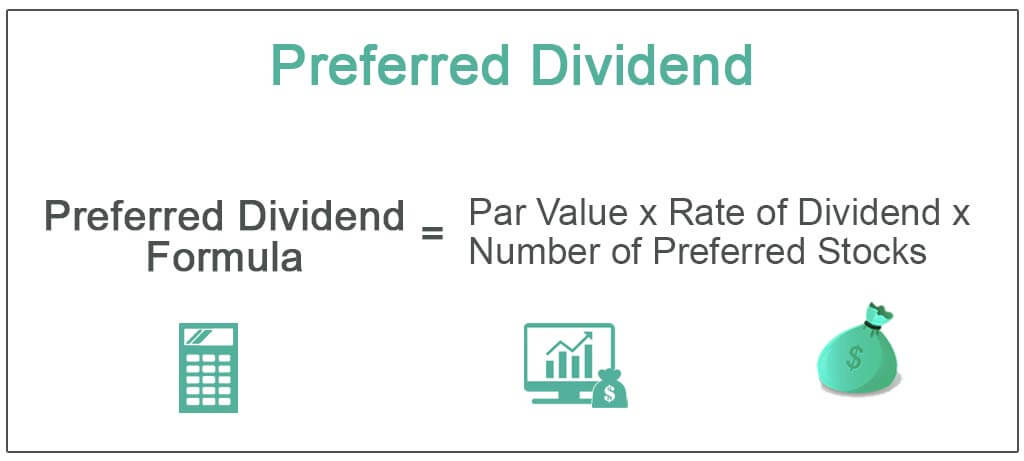

Preferred Dividend Definition Formula How To Calculate

Cost Of Capital Concept Components Importance Example Formula And Significance

Preferred Stock Asset Managment Lecture Slides Docsity

Common Stock Formula Calculator Examples With Excel Template

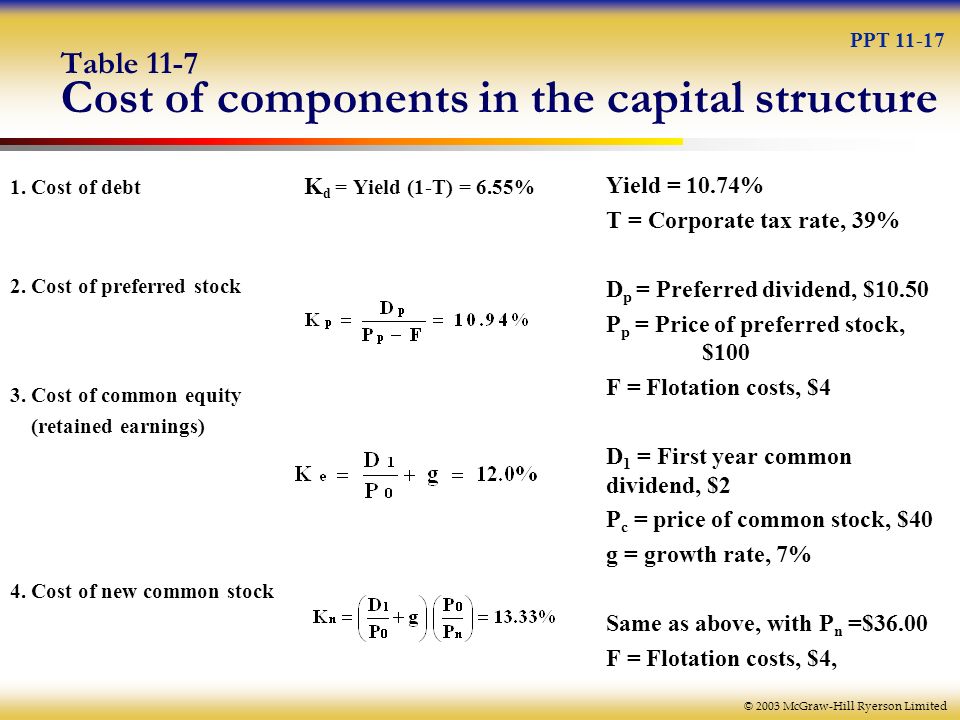

Overview Of The Cost Of Capital Ppt Download

11 Chapter Cost Of Capital Based On Terry Fegarty Carol Edwards Ppt Video Online Download

Determining The Value Of A Preferred Stock

Cima F2 Cost Of Preference Shares Youtube

Answered Grill Works And More Has 8 Percent Bartleby

Cost Of Preference Share Capital

Wacc Formula Definition And Uses Guide To Cost Of Capital

Wacc Calculation What Is It Formula Importance Practical Example

Solved Question 8 10 Pts What Is The Formula For The Chegg Com

Cost Of Capital N N Basic Skills Time

Flotation Cost Definition Formula How To Calculate

How To Calculate The Value Of A Preferred Stock In Microsoft Excel Microsoft Office Wonderhowto

How To Calculate Discount Rate In A Dcf Analysis

Preferred Dividend Definition Formula How To Calculate

Posting Komentar untuk "Cost Of Preferred Stock Formula"