Overtime Pay Philippines Labor Code

While work performed beyond eight hours on a holiday or rest day shall be paid an additional compensation equivalent to the rate of the first eight hours on a holiday or rest day plus at least thirty percent 30 thereof Article 87 of the Labor Code of the Philippines. Under the Labor Code employees who work between the specified time shall be paid a night shift differential of not less than 10 of the regular wage for each hour of worked performed.

Labor Law Every Employee Has A Right To 60 Minutes Of Meal Break Every Day

M a n i l a.

Overtime pay philippines labor code. Undertime not offset by overtime. 32 Different Pay Rates. Permission given to the employee to go on leave on some other day of the week shall not exempt the employer from paying the additional compensation required in this Chapter.

Moreover work hours may fall under. Article 87 of the Philippine Labor Code states that any work that exceeds eight hours is considered overtime work. The rate of overtime pay is additional 25 of the hourly rate for work performed in excess of eight 8 hours on ordinary day.

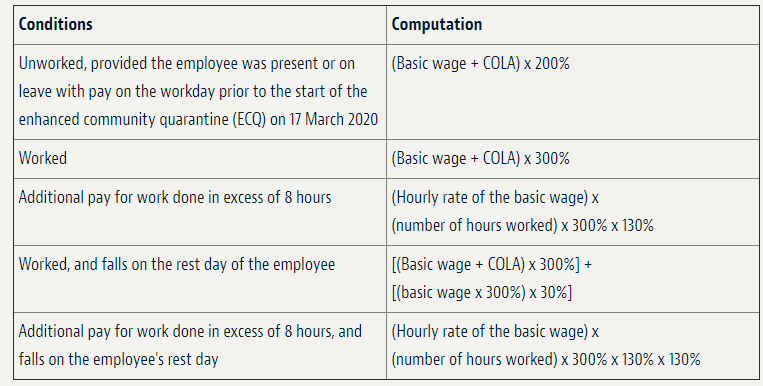

As well as those provided under special laws such as 13th month pay. What is the computation for overtime pay on a rest day. What is the computation for overtime pay on a special day.

12 series of 2019 which prescribes the proper payment of wages for the special non-working days on December 8 24 and 31. Labor Code of the Philippines Article 87 90. This should be your regular holiday pay computation.

Article 88 of the Labor Code enunciates that undertime work on a business day shall not be offset by overtime work on any other day. In accordance with Article 86 of the Labor Code of the Philippines every employee must be paid a night shift differential. Calculating for your employees overtime holiday rest day andor night differential premiums is not a walk in the park.

Republic of the Philippines. 18000 x 12 258 x 13 Php108837 Beyond 8 hours. Currently the Labor Code stipulates that an employee who works beyond 8 hours a day be paid an additional compensation equal to that employees regular wage plus.

A DECREE INSTITUTING A LABOR CODE THEREBY REVISING AND CONSOLIDATING LABOR AND SOCIAL LAWS TO AFFORD PROTECTION TO LABOR PROMOTE EMPLOYMENT AND HUMAN RESOURCES DEVELOPMENT AND INSURE INDUSTRIAL PEACE BASED ON SOCIAL JUSTICE. The employer must also pay the employees the compensation and other benefits to which they are entitled under the Labor Code such as overtime pay night shift pay holiday pay etc. Article 82 of the Labor Code specifically provides that managerial employees among others are not covered by the provisions on working conditions and rest periods which includes overtime pay.

For the next article well be focusing on the 32 different pay rates prescribed by the Code. Notwithstanding the provisions of Articles 129 and 217 of this Code to the contrary and in cases where the relationship of employer-employee still exists the Secretary of Labor and Employment or his duly authorized representatives shall have the power to issue compliance orders to give effect to the labor standards provisions of this Code and. The answer to your query lies on the nature of your office and the function you perform for the company.

Hourly rate x 200 x 130 x number of hours worked. This is particularly essential when computing for overtime pay holiday pay and night differential as discussed above. Lets say your hourly rate is PHP 125 and you worked overtime for two hours for total overtime of 10 hours.

Work performed beyond eight hours on a holiday or rest day shall be paid an additional compensation equivalent to the rate of the first eight hours on a holiday or rest day plus at least thirty percent 30 thereof. The law discourages the offset because the hourly rate of overtime is higher than the hours missed when an employee works for less than eight hours. The labor department reminded private sector employers to properly pay their workers who will report for work during the December holidays.

The computation for the wage is his regular wage plus at least twenty-five percent 25 of his hourly wage. In fact there are 32 different combinations at play. Beyond 8 hours 169 hour First 8 hours.

Form payee time and place of payment of wages Form. The Labor Code mandates the payment of overtime pay for additional pay for work performed in excess of the normal work hours of 8 hours a day. To guide employers Labor Secretary Silvestre Bello III issued Labor Advisory No.

As used in the said article managerial employees refer to those whose primary duty consists of. Same values used in the computation. This is legal provided that the employee is paid for the overtime work.

Article 87 tells us what overtime work is as well as how much an employee should be paid for putting in extra hours. First 8 hours 130. The compensation for each hour of work done between ten oclock in the evening and six oclock in the morning shall not be less than ten percent 10 of his or her regular wage.

Undertime not offset by overtime. This infographic is part of an ongoing series that summarizes the Labor Code of the Philippines for businesses. Overtime work refers to work rendered beyond 8 hours and the employee who renders overtime work shall earn an additional pay of 25.

You should as a rule pay in cash. 18000 x 12 258 x 1698 Php17686hour. 442 AS AMENDED May 1 1974.

- Undertime work on any particular day shall not be offset by overtime work on any other day. An employee may be required by the employer to perform overtime work in case of war in order to prevent loss of life or property etc due to actual or impending emergency in the locality by serious accidents or in case of urgent work to be performed on machines to avoid a serious loss to the employer etc. Any employee covered by this Rule who is permitted or required to work beyond eight 8 hours on ordinary working days shall be paid an additional compensation for the overtime work in the amount equivalent to his regular wage plus at least twenty-five percent 25 thereof.

PHP 125 x 2 x 130 x 10 hours PHP 3250. The Philippine Labor Code. The amount of 13 th month pay shall at least be 112 of the total basic salary earned for the year which shall n include all earnings paid by hisher employer for services rendered but does not include allowances and other monetary benefits such as the cash equivalent of unused vacation and sick leave credits overtime premium night shift differential holiday pay and COLA.

Calculating Overtime Holiday And Night Differential Premiums

Labor Laws Of The Philippines Chan Robles And Associates Law Firm

Some Frequently Asked Questions By Employees Answered Stela Benitez

Philippine Labor Law Basic Faqs

Labor Code Of The Philippines Youtube

Suggested Answers In Labor Law Batasnatin

Labor Laws Of The Philippines Chan Robles And Associates Law Firm

10 Labor Code Provisions Every Employee Must Know

Employment Labour Law 2021 Brazil Iclg

Labor Code Changes In The Philippines Blue Marble Global Payroll

How To Compute Overtime Pay With Illustrations Using Ncr Daily Minimum Wage Lvs Rich Publishing

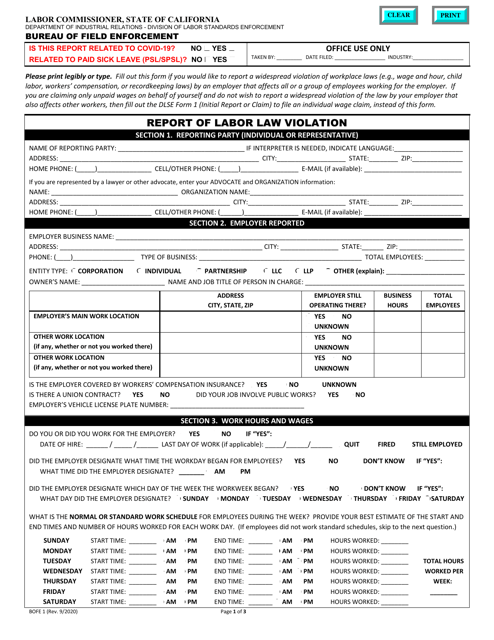

Form Bofe1 Download Fillable Pdf Or Fill Online Report Of Labor Law Violation California Templateroller

Calculating Overtime Holiday And Night Differential Premiums

Dole Issues Guidelines On Holiday Pay And Probationary Period During Ecq In Ph Lexology

Chart Summarizing 2019 California Labor Law Labor Law California Employment Law

Computation Of The Estimated Equivalent Monthly Rate Eemr Of Daily Paid Employees Labor Law Helpful Hints Fyi

Dole Guidelines For 13th Month Pay In Private Sectors

Philippine Labor Contracts What You Need To Know Asean Business News

6 Labor And Ipc Law Labor Code And The Intellectual Property Code Notes From Azucena C A Studocu

Posting Komentar untuk "Overtime Pay Philippines Labor Code"