How To Report Nol Carryforward On 1040

If your NOL deduction includes more. 9 Post-allocation NOLs created in tax periods ending on or after July 31 2019 are also subject to a carryforward period of up to 20 tax years.

131 collectively changed the net operating loss and net operating loss carryover regime from pre-allocation to post allocation for privilege periods ending on and after July 31 2019 beginning on and after August 1 2018 if a full 12-month privilege period begins August 1 2018.

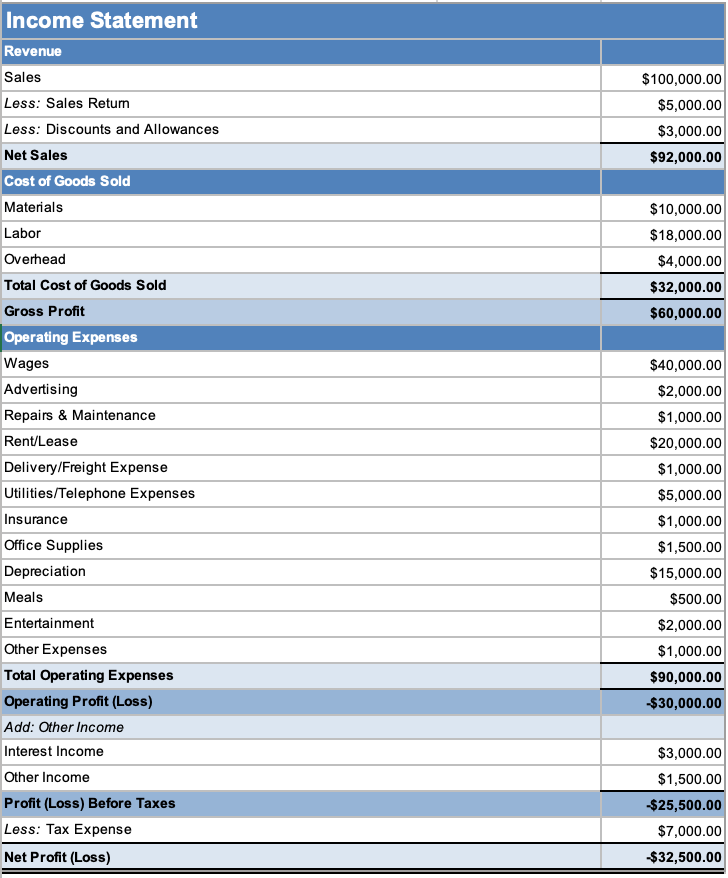

How to report nol carryforward on 1040. Then check line 41 of Form 1040 the line after itemized deductions and the standard deduction. Click the Jump to nol link Say Thanks by clicking the thumb icon in a post Mark the post that answers your question by clicking on Mark as. According to the IRS to have a net operating loss it must be caused by certain deductions.

NLD can be used to reduce the base income allocable to Illinois only if the loss year return and all other returns that are impacted by the loss year carryback and carryforward provisions have been filed and to the extent the loss was not used to offset income from any other tax year. Entering a prior year NOL on Form 1040. On Michigan Schedule NR or claim the federal NOL deduction as an addition on Michigan Schedule 1.

If you carry forward your NOL to a tax year after the NOL year list your NOL deduction as a negative figure on the Other income line of Schedule 1 Form 1040. Gains from Michigan column of MI-1040D and MI-4797 from Schedule 1. If Line 41 has a negative number this is your first clue of a possible net operating loss.

Amending the NOL. Where do I report NOL carryback on 1040. Adjusted Gross Income AGI.

Enter the amount from MI-1040 line 10 of the loss year. COMPUTE THE NET OPERATING LOSS NOL 1. Enter the corresponding amounts from Schedule 1.

To enter information or see the proformad amounts go to the NOL screen in the Carryovers folder. When carrying an NOL forward enter the NOL amount as a minus number on line 21 of Form 1040 and attach a statement to your return explaining how the carryover was computed. Michigan Net Operating Loss Carryforward.

If you file an amended MI-1040 for a loss year which changes your NOL you must include an amended. For Illinois net losses in tax years ending on or after December 31 2003 Illinois net losses can no longer. Log into Turbo Tax.

You must attach a statement that shows all the important facts and should include a computation showing how you figured your NOL. With this entry a statement declaring the election to carryforward any net operating loss per Section 172 b 3 prints on the Schedule A - Net Operating Loss NOL form. From the Main Menu of the tax return Form 1040 select.

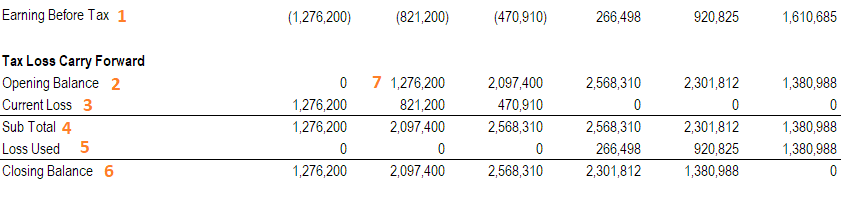

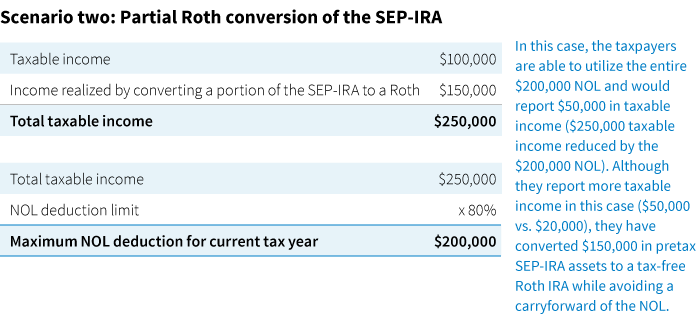

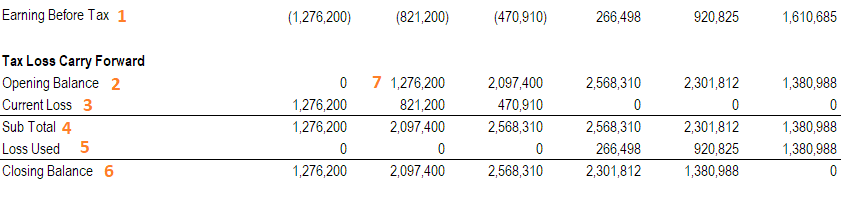

Scroll to line 14 and enter the Net Operating Loss NOL Carryforward as a positive amount. If the years are not entered in ascending order they are sorted in ascending order for the NOL carryover worksheet. A Tax Loss Carryforward also called a Net Operating Loss NOL carryforward is a mechanism firms can use to carry forward losses from prior years to offset f.

Post-allocation NOLs arising from tax periods ending on or after July 31 2019 can only be applied to. The first thing you must do before even worrying about NOLs is complete your individual income return Form 1040. NOL Carryforward worksheet or statement.

Do not report a Michigan NOL deduction. Business IncomeLoss Sch C 1099-MISC 1099-NEC Select the Schedule C or create it if needed. Select Section 1 - NOL Schedule A.

These include expenses related trade or business casualty and theft. From the Main Menu of the tax return Form 1040 select. Select section 5 - NOL Carryovers from Prior Years.

Select Line 2 - Elect to carryforward any current year net operating loss per Section 172 b 3. The steps for calculating the net operating loss for corporations are. If the result is a negative number you have net operating losses.

NOL was carried foward from IRS form 1040. This item is displayed on line 41 on Form 1040 US. The following columns are available on that screen.

Carryover from Prior Years Entering an unallowed loss on Schedule C. There are no carrybacks in prior years on the Federal tax returns as computed on form 1040 only carry fowards. Use the worksheet in IRS Publication 536 each year to compute the remaining NOL to carry forward.

Deduct the NOL in the carryback or carryforward year. An eligible loss may be carried back three years. Go to the IncomeDeductions Net Operating Loss worksheet.

Enter NOLs as negative numbers for each of the prior tax years. Information was consistently transferred from Form 1040 to State form 500. Income Loss This column should reflect the taxable income or net operating loss for each of the preceding periods.

Type NOL into the search box at the right-hand top of the screen. An eligible loss is any part of an NOL that is from. Check your Federal Carryover Worksheet from your 2018 return for the amount.

Note that the taxpayers NOL was generated from Form 1120S and entered on Form 1040. PNOLCCs have a carryforward period of up to 20 tax years following the year of the initial loss. Carry over the unused NOL to the next carryback or carryforward year and begin again at Step 4.

Years earlier than 1997 are ignored. Open the Federal Carryover Worksheet press F6 and type CO. Based on entries in the return the program will calculate the NOL Carryforward to next year.

Type nol in the Search area then click on Jump to nol. You should be able to enter your Net Operating Loss carryover amounts without issue screenshot. Individual Income Tax Return.

To deduct a carryforward list your NOL deduction as a negative number on line 21 of Form 1040. The full amount of NOL carryover available will show per IRS guidelines. See How To Figure an NOL Carryover later.

Determine the amount of your unused NOL. In line 1 - Year carried from enter the year from which the regular or AMT net operating loss is carried. Carryback Rule for an Eligible Loss.

How to Report an NOL Carryover. See How To Claim an NOL Deduction later.

Solved Nol Carryforward Worksheet Or Statement

1040 Net Operating Loss Faqs Nol Schedulec Schedulee Schedulef

Irs Issues Expedited Nol Carryback Filing Process Grant Thornton

Rules For Nols Change Under Tax Reform Putnam Wealth Management

A Small Business Guide To Net Operating Loss The Blueprint

Solved Entering Prior Year Nols By Year Intuit Accountants Community

Solved Nol Carryforward Worksheet Or Statement

How Do I Put My Nol Carryforward In The 2019 Versi

1040 Net Operating Loss Faqs Nol Schedulec Schedulee Schedulef

Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes

1040 Net Operating Loss Faqs Nol Schedulec Schedulee Schedulef

Nol Carryforward 2019 Intuit Accountants Community

Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes

Posting Komentar untuk "How To Report Nol Carryforward On 1040"