What Are The Risks Of An Mnc Which Expands Internationally

Growth in international business can be stimulated by 1 access to foreign resources which can reduce costs or 2 access to foreign markets which boost revenues. However if this investment is successful all of the benefits accrue to the MNC.

Motives of an MNC.

What are the risks of an mnc which expands internationally. Identify the more obvious risks faced by MNCs that expand internationally. The MNC may have trouble selling the firm it acquired for a reasonable price. Why do you think European countries attract US.

What are the risks of an MNC which expands internationally. Thus there is more risk. Point out that imports from overseas a liates make up nearly a half of US imports.

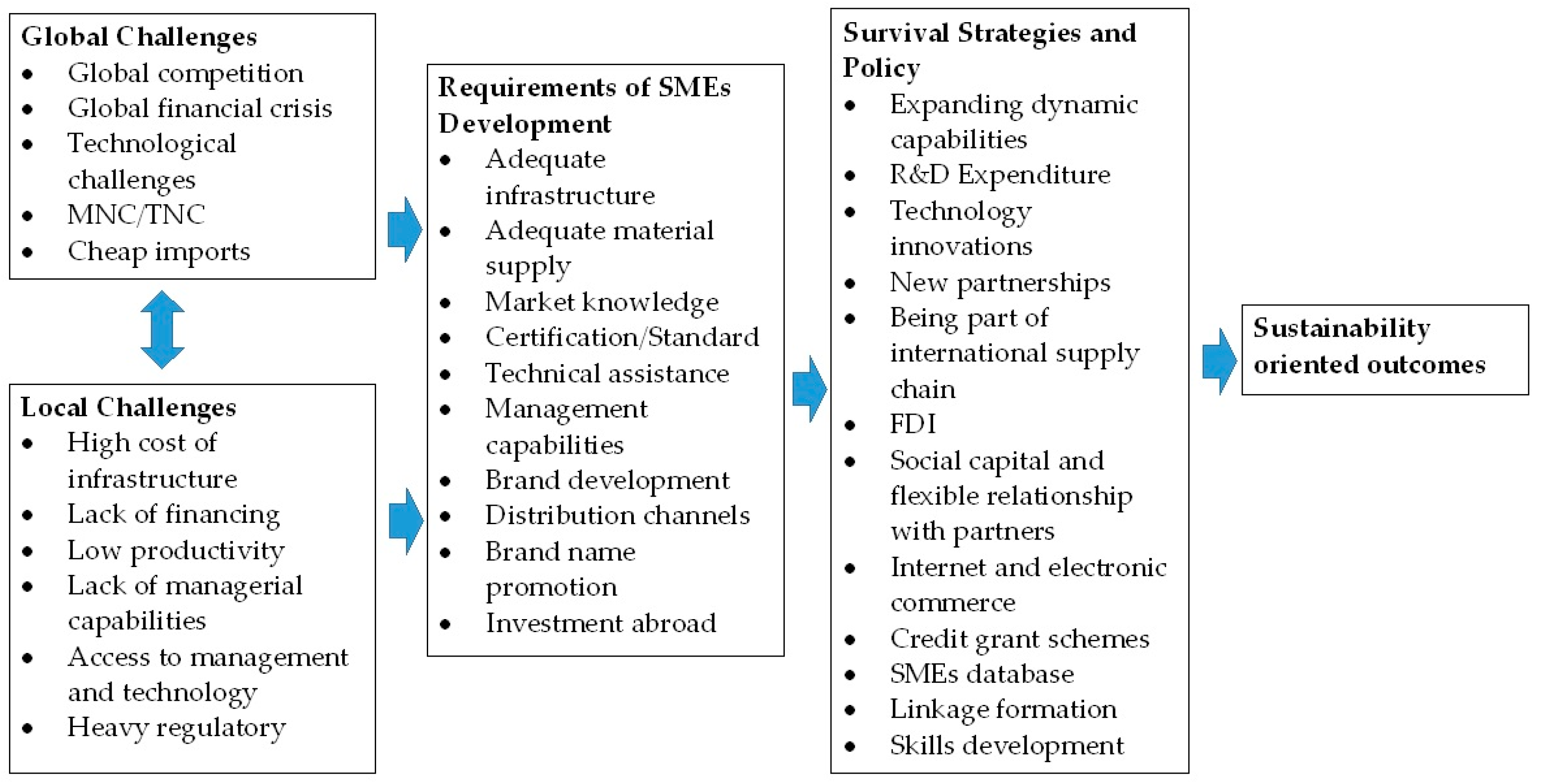

Why does an MNC expand internationally. Multinational corporations are less affected by localized recessions than companies that only operate in one nation. An MNC that expands internationally faces risks related to the different countries and regions in which it plans to operate including institutional failures crime political instability and.

Additionally companies that operate in several nations have a wider pool of potential customers which means more opportunity to generate profits. Yet international business is subject to risks of exchange rate fluctuations and political risk such as a possible host government takeover tax regulations etc. -poor economic conditions in the foreign country.

Firm exports product to accommodate foreign demand. As a fact multinationals corporations are growing with rapidity. Due to the political changes that have occurred during the years the opportunities for multinationals corporations have increased considerably.

Multinational corporations MNCs also known as International Corporation transnational corporation global corporation and many more. -exchange rate risk which can affect the performance of the MNC in the foreign country. International finance is also an important component of a multinational corporations overall strategy.

If the government is not stable or the form of administration is unfavourable. Foreign exchange risk management is a process which involves identifying areas in the operations of the MNC which may be subject to foreign exchange exposure studying and analysing the exposure and finally selecting the most appropriate technique to eliminate the affects of these exposures to the final performance of the company. Explain why unfavorable economic or political conditions affect the MNCs cash flows required rate of return and valuation.

-country risk which reflects the risk of changing government or public attitudes toward the MNC. What are the risks of an MNC which expands internationally. Country risks which are faced on foreign direct investment are connected with the local economy which again arises due to the possibility of confiscation Government take over without compensation and also due to the possibility of expropriation Government take over with compensation Moreover there are political andor social risks both of confiscation and expropriation of wars revolution etc.

Define what is meant by a multinational corporation MNC. Firm creates product to accommodate local demand. Firm establishes foreign subsidiary to establish presence in foreign country and possibly reduce costs.

Why must purely domestic firms be concerned about the international environment. Should an MNC Reduce Its Ethical Standards to Compete Internationally. Multinational corporations use financial tools such as hedging to mitigate macroeconomic risks.

For example risks such as foreign exchange rate currency exchange risk. Identify the more obvious risks faced by MNCs that expand internationally. Describe constraints that interfere with an MNCs objective.

Yet international business is subject to risks of exchange rate fluctuations foreign exchange restrictions a host government takeover tax regulations etc. Risks With Being a Multinational Corporation. Firm differentiates product from competitors andor expands product line.

Why must purely domestic firms be concerned about the international environment. What are the risks of an MNC which expands internationally. Why does an MNC expand internationally.

It can become difficult to survive for a business in such a country. However multinational corporations also have to contend with a variety of risks that. Risks for an MNC include.

When an organization engages in international financing activities it takes on additional risk including foreign exchange risk and political risk. Academiaedu is a platform for academics to share research papers. Some of the risks.

What are typical reasons why MNCs expand internationally. These risks are again primarily focussed on businesses operating in developing countries which are differentiated by their lack of economical and technological development strong national and cultural affiliation and unpredictability in political and legal changes. Theories of MNC entry and expansion are collectively broad enough to o er predictions.

Why does an MNC expand internationally.

Multinational Enterprises And Structural Transformation In Emerging And Developing Countries A Survey Of The Literature Sciencedirect

International Marketing Quick Guide

Week 1 Response Fin 340 International Finance Tcnj Studocu

International Sales How To Sell In A Global Market Salesforce Com

Pdf Risk Management Rethinking Fashion Supply Chain Management For Multinational Corporations In Light Of The Covid 19 Outbreak

Economies Free Full Text A Review Of Global Challenges And Survival Strategies Of Small And Medium Enterprises Smes Html

When Geography Matters International Diversification And Firm Performance Of Spanish Multinationals Brq Business Research Quarterly

Types Of International Business Boundless Management

/GettyImages-875074102-a7b9ef3d059e41a2a624014ed0e2a963.jpg)

Top Risks For International Businesses

Posting Komentar untuk "What Are The Risks Of An Mnc Which Expands Internationally"