Under Accrual Basis Accounting Revenues Are Always Recognized When

Accrual basis of accounting is preferred over cash basis because of the following reasons. Meanwhile it must acknowledge that it expects future income.

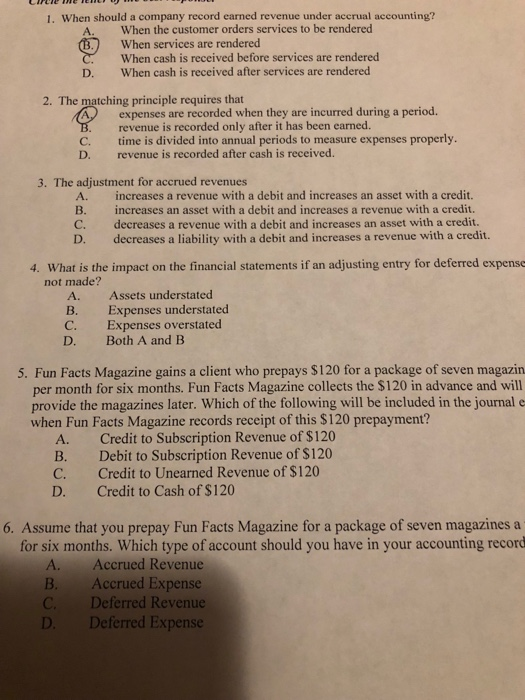

Solved 1 When Should A Company Record Earned Revenue Under Chegg Com

At the end of the month when the company receives payment from its debtors customers.

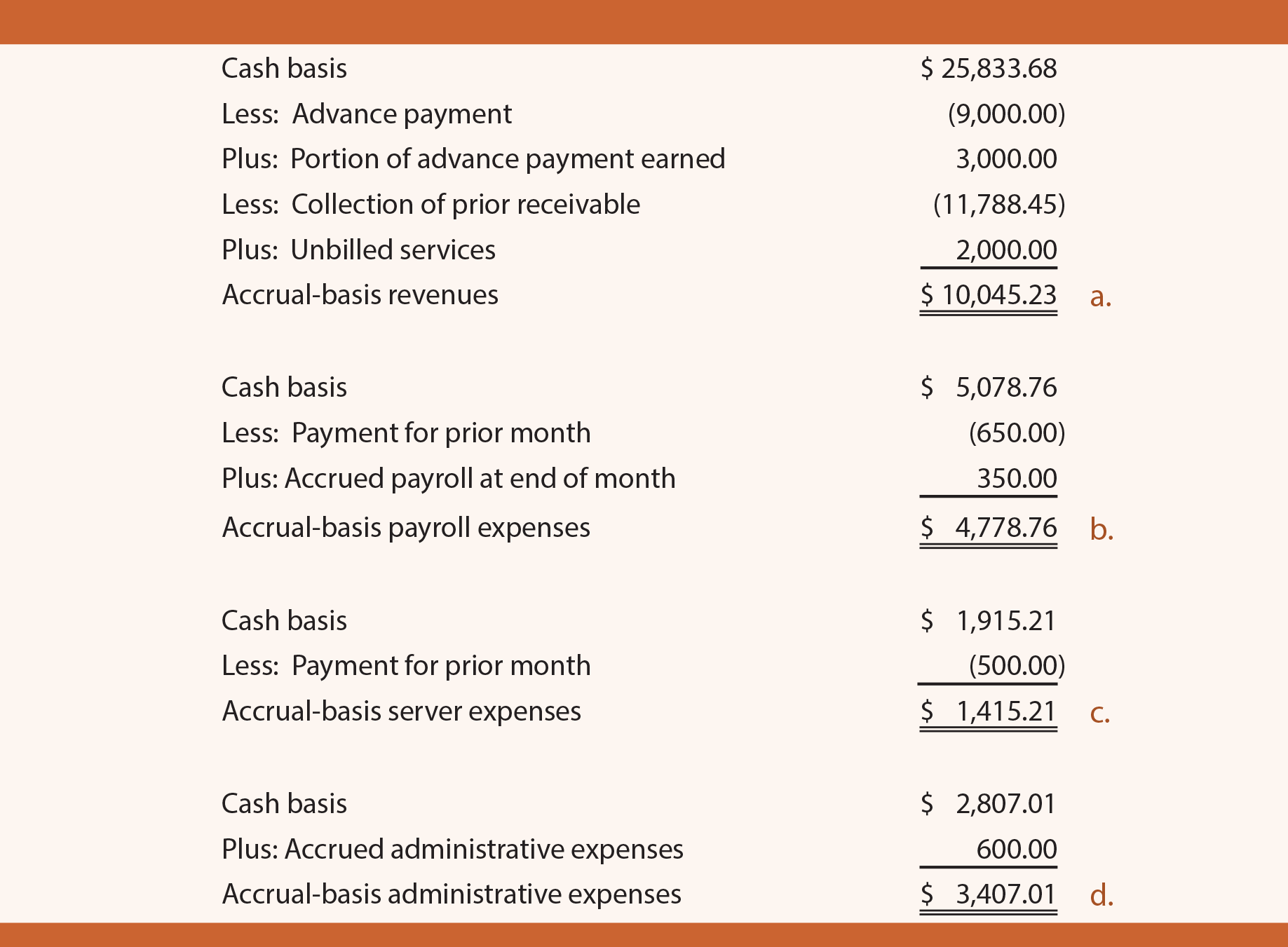

Under accrual basis accounting revenues are always recognized when. This means it is unimportant with regard to recognition when a business pays cash to settle an expense. Under accrual accounting revenues are recognized when they are realized payment collected or realizable the seller has reasonable assurance that payment on goods will be collected and when they are earned usually occurs when goods are transferred or services rendered. EARNED The idea that all expenses incurred in generating revenues should be recognized.

Definition of Accrual Basis of Accounting. Revenue is recognized when both of the following conditions are met. Under the accrual system an expense is not recognized until it is incurred.

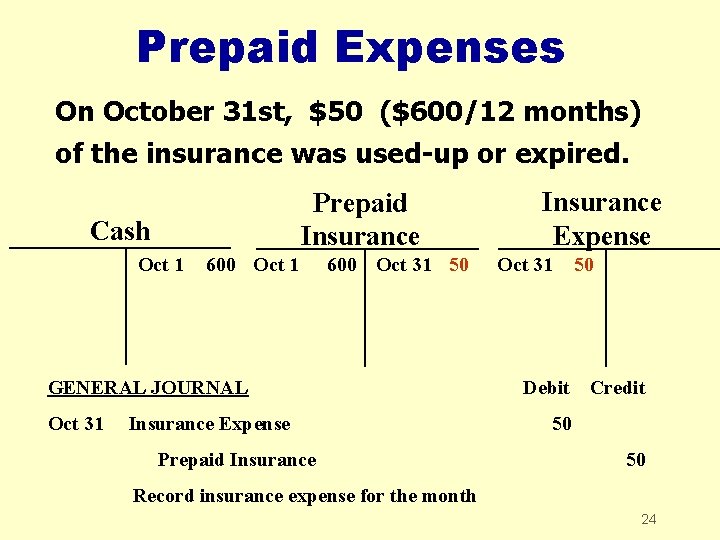

Under the accrual basis of accounting revenues and expenses are recorded as soon as transactions occur. Under the accrual basis of accounting income is recognized when earned not when cash is collected and expense are recognized when incurred not when cash is disbursed. If the income statement approach is used to record revenues received in advance of being earned then an adjusting entry will always be necessary at the end of the accounting period.

If a business were to instead recognize expenses when it pays suppliers this. Tap card to see definition. Under accrual accounting revenues are recorded when they are earned regardless of when the cash is actually received.

The accrual basis of accounting recognizes revenues when earned a product is sold or a service has been performed regardless of when cash is received. Expenses are recognized as incurred whether or not cash has been paid out. Because all large companies use the accrual basis of accounting a thorough un-.

Property tax revenues are recognized when measurable and available. In accrual-basis accounting expenses are recognized. Higher under the cash basis than under the accrual basis 19.

This concept sounds simple enough. When the revenues are earned but cash is not received the asset accounts receivable will be recorded. In cash-basis accounting revenues are recognized.

Revenues and expenses b. Revenues are recognized as cash is received. Thus AOL-Time Warner records revenues from magazine subscriptions each month as its magazines are published and de-livered.

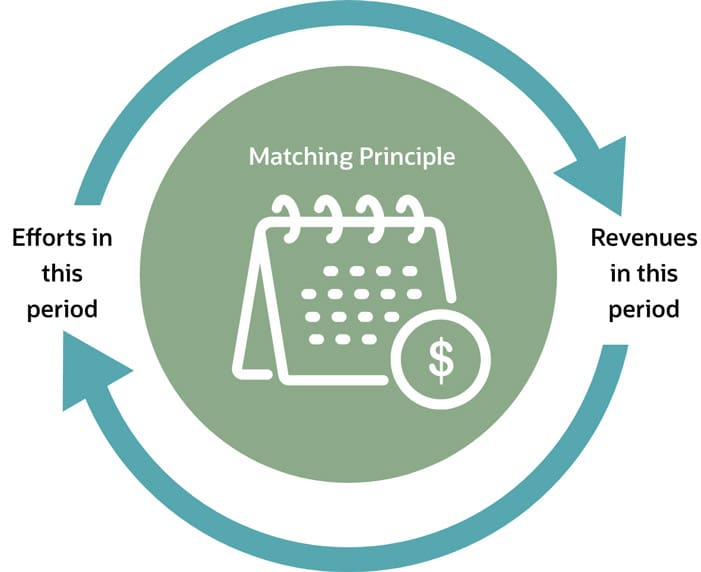

Revenues are recognized when earned and expenses are recognized when incurred under the accrual basis of accounting. Most financial reporting in the US is based on accrual basis accounting. Click again to see term.

Accounting questions and answers. The expense recognition principle is a core element of the accrual basis of accounting which holds that revenues are recognized when earned and expenses when consumed. Expenses are recognized as cash is paid.

A reporting period that starts on May 1 of the current year and ends on April 30 of the following year is. Accrued revenue refers to revenue earned in aperiod that are both unrecorded and not get received in cash example is a technician who bills customer only when the job is done. O right o wrong.

Accrual basis of accounting. Under the cash basis of accounting revenues are not reported on the income statement until the cash is received. Revenues are recognized when earned goods are delivered or services are performed.

Revenues and expenses are recognized based on the choices of management. Revenues are recognized when earned and expenses are recognized when paid under the cash basis of accounting. Revenues are recognized when earned and expenses are recognized when incurred irrespective of when cash is received or paid c.

This process runs counter to. Expenses are recognized when incurred to produce revenues. Property tax revenues are recognized when earned D.

However for many years revenue recognition differed between GAAP. If one third of the job is complete by the end of the period then the technician must record one third of the expected billing as revenue in that period even though there is no building or collection. Tap again to see term.

Accrual accounting therefore gives the company a means of tracking its financial position more accurately. Under the accrual basis of accounting or accrual method of accounting revenues are reported on the income statement when they are earned. Revenues and expenses are recognized equally over a twelve month period.

Under the cash basis of accounting revenues and expenses are recognized as. Expense is recognized in the period in which related revenue is recognized. Most companies use the accrual basis of accounting.

Accrual-basis accounting means to record revenues when they are earned when goods and services are provided to customers and record expenses in the period in which they helped generate revenue. Revenues are recognized when earned even if cash was not received. Expenses are recognized when incurred even if cash was not paid.

Revenue is earned and Revenue is realized or realizable. Question Business expenses should be recognized in the same period as the revenues. Question Under the accrual basis of accounting revenue should be recognized at the time services are rendered or when goods are sold and delivered to a customer.

Under the accrual basis of accounting revenues are recognized when earned and expenses are recognized when incurred. On July 20 2021. Revenues are recognized in the accounting period when the sale is made and expenses are recognized in the period in which they relate to the sale of the product.

The accrual basis of accounting is modified when recognizing and measuring revenues but not when recognizing and measuring expenditures C. It does not report receivables. Which statement is always true about the accrual versus cash basis of accounting.

Under the accrual basis accounting revenues and expenses are recognized by the following principles. In accrual-basis accounting revenues are recognized. For revenues it is considered earned if the services are already rendered or if the ownership over the goods are transferred.

Under accrual-basis accounting revenues are always recognized when.

Financial Management Cash Vs Accrual Accounting Texas A M Agrilife

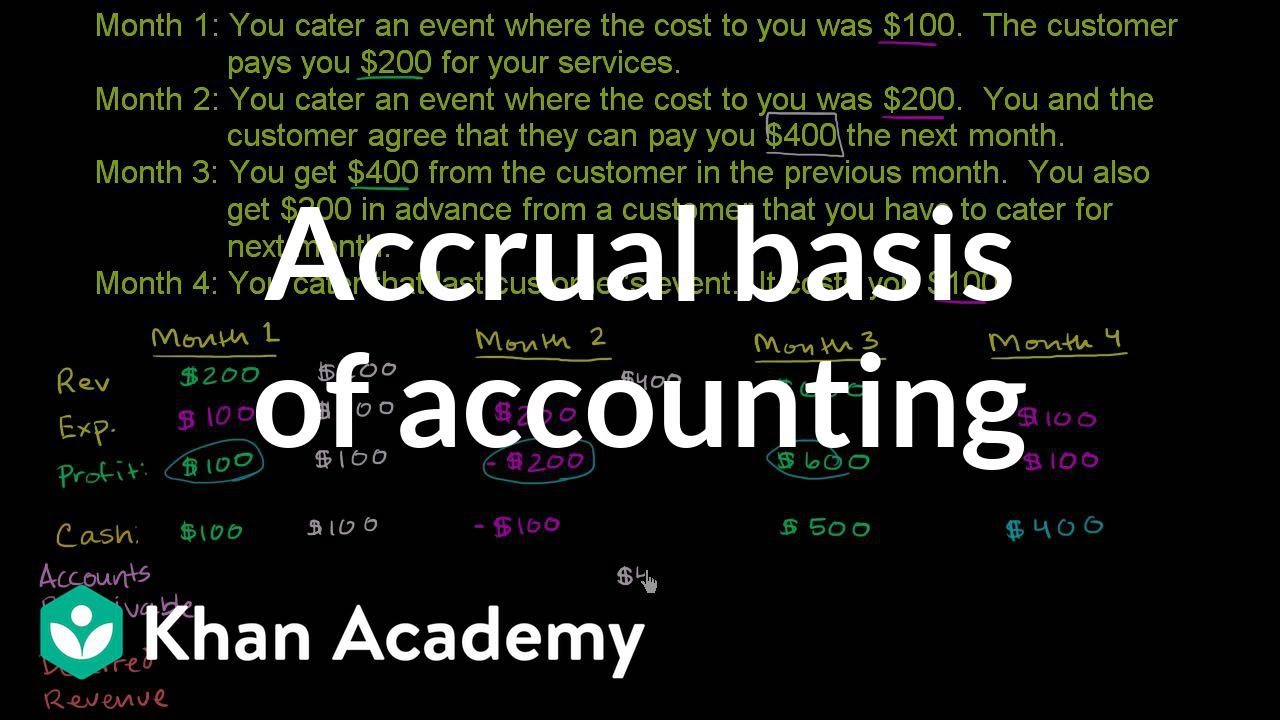

Accrual Basis Of Accounting Video Khan Academy

5 Reasons Why Accrual Accounting Is Used Because Of Need Ad Group

Chapter 4 1 Chapter 4 Accrual Accounting Concepts

Cash Vs Accrual Basis Accounting Accrual Accounting Principles

Accounting Methods Cash Basis Accounting Vs Accrual Accounting

Accounting Methods Cash Basis Accounting Vs Accrual Accounting

Accrual Concept In Accounting Definition Explanation Example Advantages Disadvantages Financial Forbes

Financial Management Cash Vs Accrual Accounting Texas A M Agrilife

Ppt Accrual Accounting Vs Cash Basis Accounting Powerpoint Presentation Id 5767843

Accrual Principle Overview How To Accrue Revenues And Expenses

Technofunc Gl Accrual Basis Accounting

Financial Management Cash Vs Accrual Accounting Texas A M Agrilife

Chapter 4 1 Chapter 4 Accrual Accounting Concepts

Accrual Accounting Concepts Examples For Business Netsuite

Oracle Erp Accrual Basis Vs Cash Basis Accounting Know Oracle

Accrual Versus Cash Basis Accounting Principlesofaccounting Com

Basis Of Accounting Complete Guide With Examples

Month End Closing Checklist Checklist Month End Payroll Taxes

Posting Komentar untuk "Under Accrual Basis Accounting Revenues Are Always Recognized When"