How To Report Employee Hsa Contributions On W2

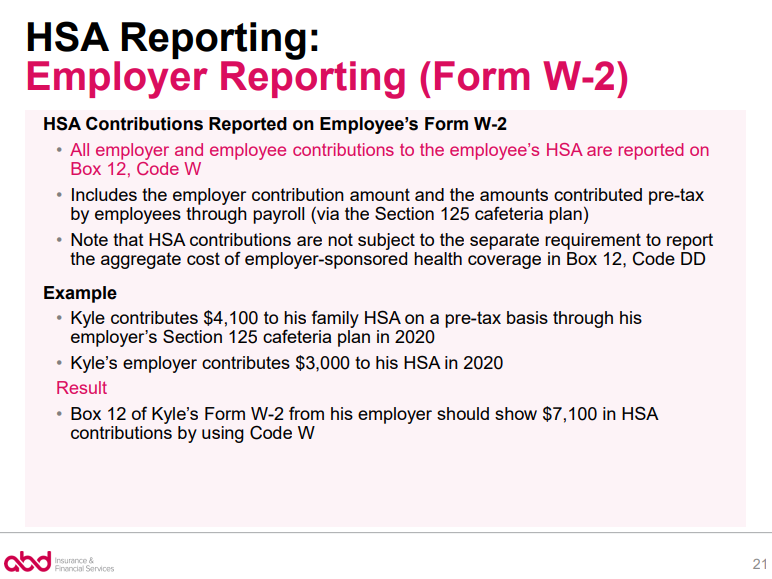

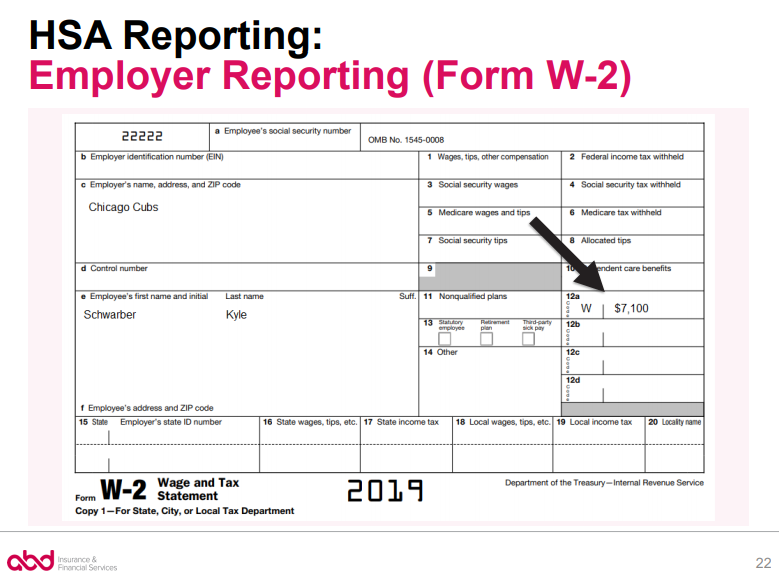

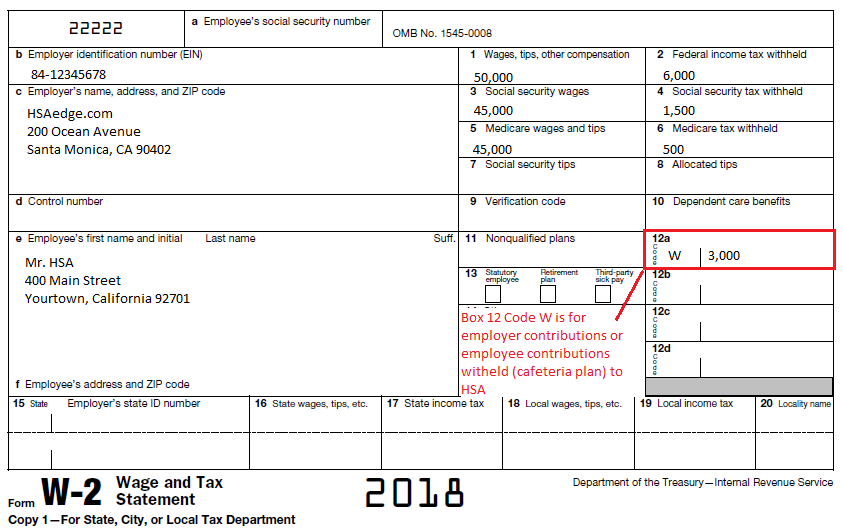

Get Your Accurate Tax Refund. If you are using a Section 125 plan both employee pre-payroll contributions and employer contributions are classified as employer contributions reported on the W-2 form as a single number in Box 12.

Complyright W 2 Tax Forms 2 Up Employer S Copy D And Or State City Or Local Copy 2 8 1 2 X 11 Whi In 2021 Tax Forms Health Savings Account Deferred Compensation

Create A Free Account Now.

How to report employee hsa contributions on w2. Health Savings Accounts HSAs Employers are required to report two types of contributions to HSAs on Form W-2. Any pre-tax HSA contributions deducted. The plan permits contributions only through employee salary reduction elections and does not offer any employer contributions.

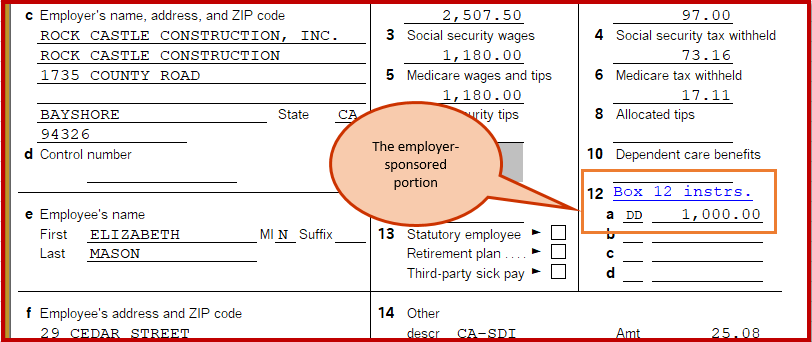

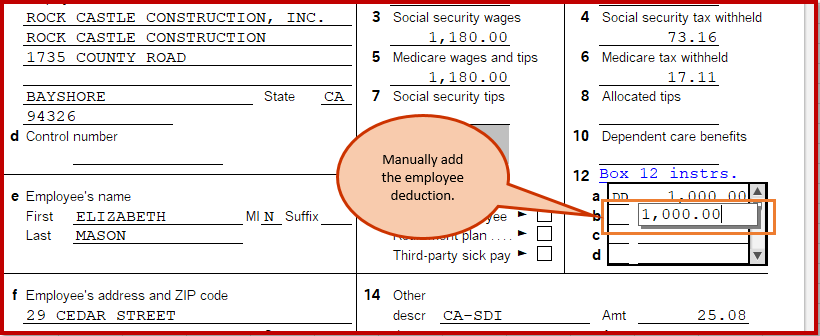

You must report all employer contributions including an employees contributions through a cafeteria plan to an HSA in box 12 of Form W-2 with code W. Employer contributions to an HSA that are not excludable from the income of the employee also must be reported in boxes 1 3 and 5. Form W -2 Reporting of Employer -Sponsored Health Coverage Coverage Type Form W -2 Box 12 Code DD Report Do Not.

The employer should have added both contributions your money and their money and entered the total box 12 W. Additionally HSA administrators must issue Form 5498-SA by May 31 of each year this is because you can contribute to your HSA for a tax year up to the due date of your personal income tax. Report your HSA deduction on Form 1040 or Form 1040NR.

For more information see IRS Publication 969 Health Savings Accounts and Other Tax-Favored Health Plans. Using box 12 code W really makes a mess of things on this side. Ad Access IRS Tax Templates Online.

A payroll item set up with the HSA Emp. Employer HSA contributions includes contributions embedded in the HealthFlex H1500 and H2000 plan designs ie HealthFlex high-deductible health plans HDHPs 2. For shareholderemployess the amount of HSA contributions should be shown in box 14 just like the shareholder health insurance premiums with a description along side.

Employees age 55 or older have an additional 1000 catch-up contribution. See Health savings account HSA Return to top of page. You do not have to get a corrected W2 although thats an option.

It is your responsibility as the account holder to keep records to support distributions and to complete Form 8889 and attach it to Form 1040. If your employer contributed to your HSA those contributions will be reported on your W-2 form as non-taxable wages. You should also have received a Form 1099-SA from your HSA administrator reporting withdrawals from the account.

Any employer contributions made to HSAs are shown on your Form W-2 in Box 12 code W. Employer contributions to an HSA that are not excludable from the income of the employee also must be reported in boxes 1 3 and 5. This information is not reported to the IRS.

Follow the instructions for Form 8889. For purposes of reporting on Form W-2 the amount of the health FSA is not included. When you are working of the HSA interview section you will arrive at a question about other contributions.

Code WEmployer contributions to a Health Savings Account HSA. Whether it was you your employer or both of you who contributed funds into your HSA account the combined amount goes into this box. Since the employer is responsible for all funding to a Health Reimbursement Arrangement there are no limits in place regarding an employers contribution to an employee.

You must report all employer contributions including an employees contributions through a cafeteria plan to an HSA in box 12 of Form W-2 with code W. HSA Omitted From W-2 Form. You must report all employer contributions to an HSA in box 12 of Form W-2 with code W.

See IRS W-2 Instructions. Youll find the correct amount on your W-2 form box 12 code W. Pretax Tax Tracking Type supports employee contributions and QuickBooks automatically flows the contribution to the employees Form W.

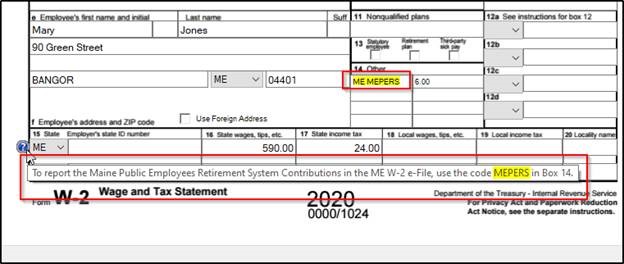

For example while contributions to Health Savings Arrangements HSA are not to be reported in Box 12 Code DD certain HSA contributions are reported in Box 12 Code W see General Instructions for Forms W-2 and W-3. An HSA has a maximum contribution of 3400 from both the employee and the employer for single employees. Use box 14 if railroad retirement taxes apply.

For employees who have dependents on their insurance plan the contribution is 6850. An employee makes a 2000 salary reduction election for several qualified benefits under the plan including a health FSA for 1500. Show any employer contributions including amounts the employee elected to contribute using a section 125 cafeteria plan to an HSA.

W-2 reporting of the employee contribution - Standard Enhanced and Assisted Payroll customers only. Your employers contributions also will be shown in box 12 of Form W-2 Wage and Tax Statement with code W. The Box 12 W Code on your W-2 represents the total pre-tax contributions to your HSA.

When you look at your W-2 Box 12 should have a section that lists your HSA contributions along with the letter W This is the code specific to HSA contributions. Get Trusted W-2 Forms - Fill Out And File - 100 Free. Report Your Wages Without Errors.

Employer contributions to an HSA that are not excludable from the income of the employee must also be reported in boxes 1 3 and 5. I am not finding any different instructions for retirees with no income.

Wage Tax Statement Form W 2 What Is It Do You Need It

Complyright W 2 Tax Forms 4 Up N Style Employee S Copies B C 2 2 Combined Laser 8 1 2 X 11 P In 2021 Tax Forms Health Savings Account Deferred Compensation

We Have A Deduction Contribution Payroll Item In Qb Online Under The Category Health Insurance Will This Contribution Track To Box 12 Of The W 2 With The Code Dd

Complyright W 2 Tax Forms 3 Part Twin Set 2 Up Employer S Copies B C 2 1 Wide Continuous 9 X 1 In 2021 Tax Forms Health Savings Account Deferred Compensation

How To Report Qsehra Benefits On Irs Form W 2 With Exceptions Core Documents

Understanding Your W 2 Controller S Office

Hsa Form W 2 Reporting Newfront Insurance And Financial Services

Adjusting W 2 Box 14 Entries Das

Hsa Form W 2 Reporting Newfront Insurance And Financial Services

Hsa Form W 2 Reporting Newfront Insurance And Financial Services

Hsa Form W 2 Reporting Newfront Insurance And Financial Services

Box 12w Hsa Employer Contributions Asap Help Center

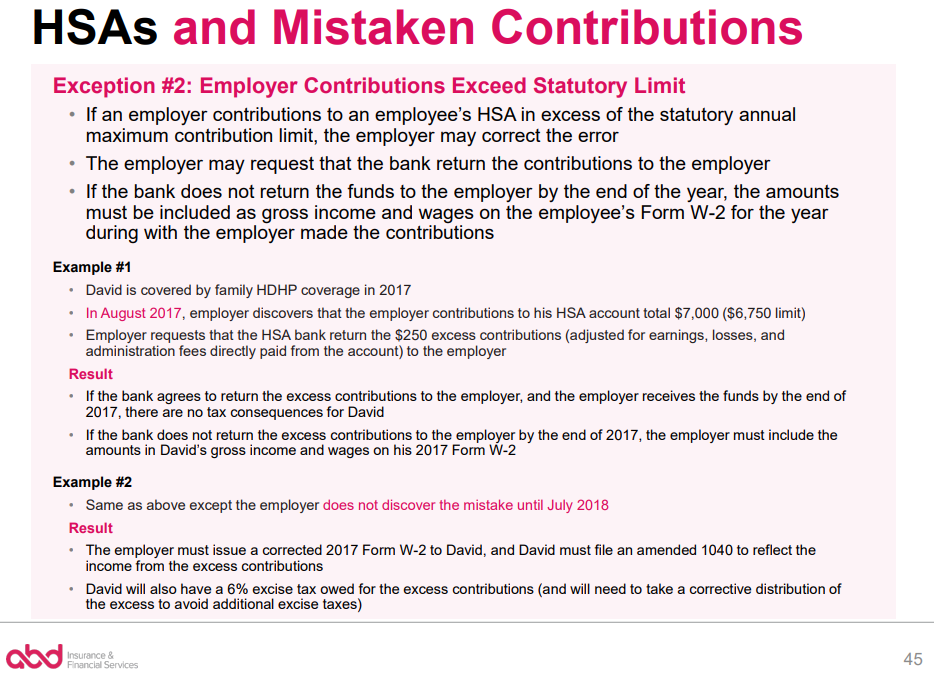

Excess Hsa Contributions Newfront Insurance And Financial Services

We Have A Deduction Contribution Payroll Item In Qb Online Under The Category Health Insurance Will This Contribution Track To Box 12 Of The W 2 With The Code Dd

Your W 2 Employees Help Center

Complyright W 2 Tax Forms 2 Up Employer S Copy D And Or State City Or Local Copy 2 8 1 2 X 11 Whi In 2021 Tax Forms Health Savings Account Deferred Compensation

Hsa Employer Contributions On W2 Box 12 W Hsa Edge

Reporting On Form W 2 The Cost Of Employer Sponsored Health Coverage Leavitt Group News Publications

Posting Komentar untuk "How To Report Employee Hsa Contributions On W2"